Page 131 - City of Watauga FY22 Adopted Budget

P. 131

BUDGET-OVERVIEW

prior years’ experience, as well as interest and penalties on delinquent ad valorem

taxes.

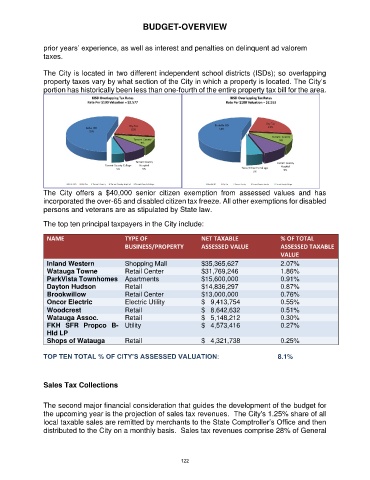

The City is located in two different independent school districts (ISDs); so overlapping

property taxes vary by what section of the City in which a property is located. The City‘s

portion has historically been less than one-fourth of the entire property tax bill for the area.

The City offers a $40,000 senior citizen exemption from assessed values and has

incorporated the over-65 and disabled citizen tax freeze. All other exemptions for disabled

persons and veterans are as stipulated by State law.

The top ten principal taxpayers in the City include:

NAME TYPE OF NET TAXABLE % OF TOTAL

BUSINESS/PROPERTY ASSESSED VALUE ASSESSED TAXABLE

VALUE

Inland Western Shopping Mall $35,365,627 2.07%

Watauga Towne Retail Center $31,769,246 1.86%

ParkVista Townhomes Apartments $15,600,000 0.91%

Dayton Hudson Retail $14,836,297 0.87%

Brookwillow Retail Center $13,000,000 0.76%

Oncor Electric Electric Utility $ 9,413,754 0.55%

Woodcrest Retail $ 8,642,632 0.51%

Watauga Assoc. Retail $ 5,148,212 0.30%

FKH SFR Propco B- Utility $ 4,573,416 0.27%

Hld LP

Shops of Watauga Retail $ 4,321,738 0.25%

TOP TEN TOTAL % OF CITY’S ASSESSED VALUATION: 8.1%

Sales Tax Collections

The second major financial consideration that guides the development of the budget for

the upcoming year is the projection of sales tax revenues. The City's 1.25% share of all

local taxable sales are remitted by merchants to the State Comptroller’s Office and then

distributed to the City on a monthly basis. Sales tax revenues comprise 28% of General

122