Page 125 - City of Watauga FY22 Adopted Budget

P. 125

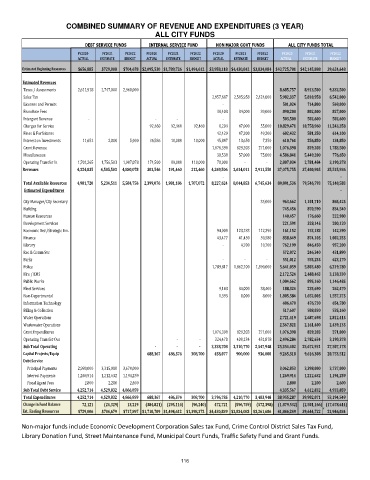

COMBINED SUMMARY OF REVENUE AND EXPENDITURES (3 YEAR)

ALL CITY FUNDS

DEBT SERVICE FUNDS INTERNAL SERVICE FUND NON MAJOR GOVT FUNDS ALL CITY FUNDS TOTAL

FY2020 FY2021 FY2022 FY2020 FY2021 FY2022 FY2020 FY2021 FY2022 FY2020 FY2021 FY2022

ACTUAL ESTIMATE BUDGET ACTUAL ESTIMATE BUDGET ACTUAL ESTIMATE BUDGET ACTUAL ESTIMATE BUDGET

Estimated Beginning Resources $656,885 $729,008 $704,678 $2,095,530 $1,789,726 $1,494,612 $3,958,118 $4,430,842 $3,834,084 $43,725,781 $42,145,888 39,624,648

Estimated Revenues

Taxes / Assessments 2,611,918 2,747,000 2,968,000 8,685,757 8,913,500 9,332,500

Sales Tax 2,957,687 2,585,958 2,424,000 5,982,337 5,810,958 6,542,000

Licenses and Permits - 501,024 714,800 569,000

Franchise Fees 38,403 34,000 30,000 890,200 802,000 827,000

Intergovt Revenue - - - - 503,500 502,600 502,600

Charges for Service 92,460 92,460 92,460 8,204 47,000 55,000 10,829,471 10,758,960 11,243,358

Fines & Forfeitures 42,429 47,200 49,200 602,432 581,350 614,100

Interest on Investments 11,652 2,000 5,000 36,586 10,000 10,000 45,847 13,650 7,350 610,761 256,850 134,850

Grant Revenue 1,076,398 829,203 271,000 1,076,398 829,203 1,783,500

Miscellaneous 30,538 57,000 75,000 4,586,841 5,449,200 776,650

Operating Transfer In 1,701,265 1,756,503 1,907,078 174,500 89,000 110,000 70,000 - - 2,807,034 2,781,484 3,190,378

Total Current Year

Revenues 4,324,835 4,505,503 4,880,078 303,546 191,460 212,460 4,269,506 3,614,011 2,911,550 37,075,755 37,400,905 35,515,936

- -

Total Available Resources 4,981,720 5,234,511 5,584,756 2,399,076 1,981,186 1,707,072 8,227,624 8,044,853 6,745,634 80,801,536 79,546,793 75,140,583

Estimated Expenditures -

City Manager/City Secretary 35,000 963,662 1,101,710 865,425

Building 745,456 870,590 834,540

Human Resources 140,457 176,660 222,980

Development Services 221,591 328,145 200,120

Economic Dev./Strategic Inn. 94,008 123,183 112,390 161,152 153,183 142,390

Finance 43,477 41,450 50,580 838,649 874,105 1,002,255

Library - 4,700 10,700 762,199 846,450 957,200

Rec & Comm Svc 572,072 246,340 431,890

Parks - - - 551,012 555,255 623,170

Police 1,789,817 1,862,100 1,590,000 5,641,059 5,803,480 6,219,780

Fire / EMS 2,172,524 2,488,463 3,138,330

Public Works 1,004,662 895,160 1,146,485

Fleet Services 9,143 34,000 38,400 188,324 235,690 262,470

Non-Departmental 1,395 8,000 8,000 1,805,584 1,652,005 1,557,275

Information Technology 406,470 476,730 654,780

Billing & Collection 517,607 508,030 535,160

Water Operations 2,721,419 2,687,698 2,812,415

Wastewater Operations 2,367,821 2,161,400 2,439,135

Grant Expenditures 1,076,398 829,203 271,000 1,076,398 829,203 271,000

Operating Transfer Out - - 324,470 408,134 431,878 2,496,284 2,782,634 3,190,378

Sub Total Operating - - - 3,338,708 3,310,770 2,547,948 25,354,402 25,672,931 27,507,178

Capital Projects/Equip 688,367 486,574 308,700 458,077 900,000 936,000 9,265,318 9,616,308 20,753,512

Debt Service

Principal Payments 2,980,000 3,315,000 3,670,000 3,062,853 3,398,000 3,737,000

Interest Payments 1,269,914 1,212,632 1,194,259 1,269,914 1,212,632 1,194,259

Fiscal Agent Fees 2,800 2,200 2,600 2,800 2,200 2,600

Sub Total Debt Service 4,252,714 4,529,832 4,866,859 4,335,567 4,612,832 4,933,859

Total Expenditures 4,252,714 4,529,832 4,866,859 688,367 486,574 308,700 3,796,785 4,210,770 3,483,948 38,955,287 39,902,071 53,194,549

Change in Fund Balance 72,121 (24,329) 13,219 (384,821) (295,114) (96,240) 472,721 (596,759) (572,398) (1,879,532) (2,501,166) (17,678,614)

Est. Ending Resources $729,006 $704,679 $717,897 $1,710,709 $1,494,612 $1,398,372 $4,430,839 $3,834,083 $3,261,686 41,846,249 39,644,722 21,946,034

Non-major funds include Economic Development Corporation Sales tax Fund, Crime Control District Sales Tax Fund,

Library Donation Fund, Street Maintenance Fund, Municipal Court Funds, Traffic Safety Fund and Grant Funds.

116