Page 367 - Southlake FY22 Budget

P. 367

SPECIAL rEVEnUE FUnDS EXPEnDITUrES

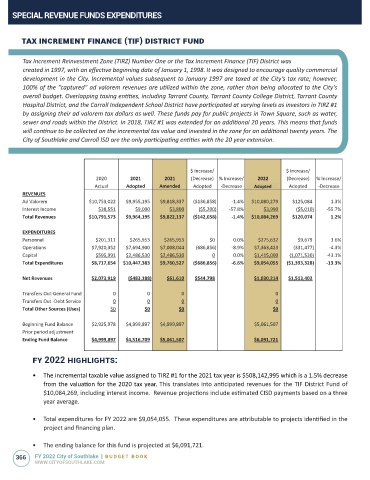

tax increment Finance (tiF) district Fund

Tax Increment Reinvestment Zone (TIRZ) Number One or the Tax Increment Finance (TIF) District was

created in 1997, with an effective beginning date of January 1, 1998. It was designed to encourage quality commercial

development in the City. Incremental values subsequent to January 1997 are taxed at the City’s tax rate; however,

100% of the “captured” ad valorem revenues are utilized within the zone, rather than being allocated to the City’s

overall budget. Overlapping taxing entities, including Tarrant County, Tarrant County College District, Tarrant County

Hospital District, and the Carroll Independent School District have participated at varying levels as investors in TIRZ #1

by assigning their ad valorem tax dollars as well. These funds pay for public projects in Town Square, such as water,

sewer and roads within the District. In 2018, TIRZ #1 was extended for an additional 20 years. This means that funds

TIF OPERATING FUND

will continue to be collected on the incremental tax value and invested in the zone for an additional twenty years. The

City of Southlake and Carroll ISD are the only participating entities with the 20 year extension.

2022 Proposed and 2021 Revised Budget

$ Increase/ $ Increase/

2020 2021 2021 (Decrease) % Increase/ 2022 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

Adopted

REVENUES

Ad Valorem $10,753,022 $9,955,195 $9,818,337 ($136,858) -1.4% $10,080,279 $125,084 1.3%

Interest Income $38,551 $9,000 $3,800 ($5,200) -57.8% $3,990 ($5,010) -55.7%

Total Revenues $10,791,573 $9,964,195 $9,822,137 ($142,058) -1.4% $10,084,269 $120,074 1.2%

EXPENDITURES

Personnel $201,311 $265,953 $265,953 $0 0.0% $275,632 $9,679 3.6%

Operations $7,920,352 $7,694,900 $7,008,044 (686,856) -8.9% $7,363,423 (331,477) -4.3%

Capital $595,991 $2,486,530 $2,486,530 0 0.0% $1,415,000 (1,071,530) -43.1%

Total Expenditures $8,717,654 $10,447,383 $9,760,527 ($686,856) -6.6% $9,054,055 ($1,393,328) -13.3%

Net Revenues $2,073,919 ($483,188) $61,610 $544,798 $1,030,214 $1,513,402

Transfers Out-General Fund 0 0 0 0

Transfers Out -Debt Service 0 0 0 0

Total Other Sources (Uses) $0 $0 $0 $0

Beginning Fund Balance $2,925,978 $4,999,897 $4,999,897 $5,061,507

Prior period adjustment

Ending Fund Balance $4,999,897 $4,516,709 $5,061,507 $6,091,721

fy 2022 highlighTs:

• The incremental taxable value assigned to TIRZ #1 for the 2021 tax year is $508,142,995 which is a 1.5% decrease

from the valuation for the 2020 tax year. This translates into anticipated revenues for the TIF District Fund of

$10,084,269, including interest income. Revenue projections include estimated CISD payments based on a three

year average.

• Total expenditures for FY 2022 are $9,054,055. These expenditures are attributable to projects identified in the

project and financing plan.

• The ending balance for this fund is projected at $6,091,721.

366 FY 2022 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM