Page 117 - Southlake FY22 Budget

P. 117

CITY PrOFILE

Tmrs funded raTiO & amOrTizaTiOn PeriOd

35.0 120.00%

30.0

30.0 29.1

28.3 28.3 100.00%

27.2 27.1

26.2 26.1 25.1 24.1 23.2

25.3

25.0 90.10%

86.60% 88.00% 87.40% 87.90% 88.70% 88.70% 89.10%

83.20% 84.50% 80.00%

81.00%

20.0 74.30% 60.00%

AMORTIZATION PERIOD (YEARS) 15.0 40.00% FUNDED RATIO (%)

10.0

20.00%

5.0

- 0.00%

Desired Funded

ratio range

CALENDAR YEAR

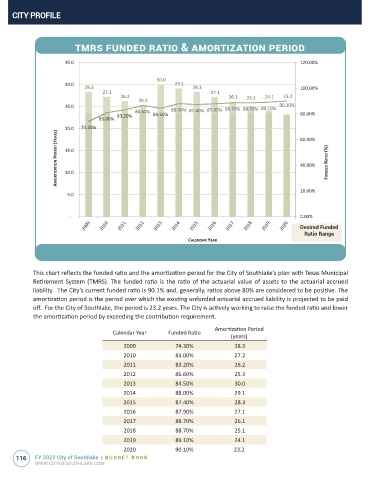

This chart reflects the funded ratio and the amortization period for the City of Southlake’s plan with Texas Municipal

Retirement System (TMRS). The funded ratio is the ratio of the actuarial value of assets to the actuarial accrued

liability. The City’s current funded ratio is 90.1% and, generally, ratios above 80% are considered to be positive. The

amortization period is the period over which the existing unfunded actuarial accrued liability is projected to be paid

off. For the City of Southlake, the period is 23.2 years. The City is actively working to raise the funded ratio and lower

the amortization period by exceeding the contribution requirement.

Amortization Period

Calendar Year Funded Ratio

(years)

2009 74.30% 28.3

2010 81.00% 27.2

2011 83.20% 26.2

2012 86.60% 25.3

2013 84.50% 30.0

2014 88.00% 29.1

2015 87.40% 28.3

2016 87.90% 27.1

2017 88.70% 26.1

2018 88.70% 25.1

2019 89.10% 24.1

2020 90.10% 23.2

116 FY 2022 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM