Page 76 - Microsoft Word - FY 2021 tax info sheet

P. 76

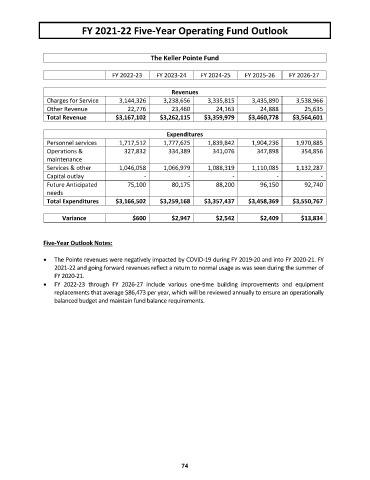

FY 2021‐22 Five‐Year Operating Fund Outlook

The Keller Pointe Fund

FY 2022‐23 FY 2023‐24 FY 2024‐25 FY 2025‐26 FY 2026‐27

Revenues

Charges for Service 3,144,326 3,238,656 3,335,815 3,435,890 3,538,966

Other Revenue 22,776 23,460 24,163 24,888 25,635

Total Revenue $3,167,102 $3,262,115 $3,359,979 $3,460,778 $3,564,601

Expenditures

Personnel services 1,717,512 1,777,625 1,839,842 1,904,236 1,970,885

Operations & 327,832 334,389 341,076 347,898 354,856

maintenance

Services & other 1,046,058 1,066,979 1,088,319 1,110,085 1,132,287

Capital outlay ‐ ‐ ‐ ‐ ‐

Future Anticipated 75,100 80,175 88,200 96,150 92,740

needs

Total Expenditures $3,166,502 $3,259,168 $3,357,437 $3,458,369 $3,550,767

Variance $600 $2,947 $2,542 $2,409 $13,834

Five‐Year Outlook Notes:

The Pointe revenues were negatively impacted by COVID‐19 during FY 2019‐20 and into FY 2020‐21. FY

2021‐22 and going forward revenues reflect a return to normal usage as was seen during the summer of

FY 2020‐21.

FY 2022‐23 through FY 2026‐27 include various one‐time building improvements and equipment

replacements that average $86,473 per year, which will be reviewed annually to ensure an operationally

balanced budget and maintain fund balance requirements.

74