Page 72 - Microsoft Word - FY 2021 tax info sheet

P. 72

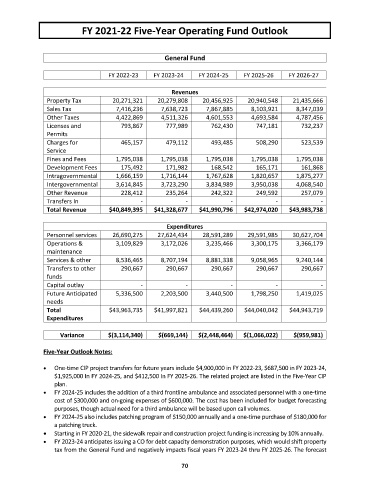

FY 2021‐22 Five‐Year Operating Fund Outlook

General Fund

FY 2022‐23 FY 2023‐24 FY 2024‐25 FY 2025‐26 FY 2026‐27

Revenues

Property Tax 20,271,321 20,279,808 20,456,925 20,940,548 21,435,666

Sales Tax 7,416,236 7,638,723 7,867,885 8,103,921 8,347,039

Other Taxes 4,422,869 4,511,326 4,601,553 4,693,584 4,787,456

Licenses and 793,867 777,989 762,430 747,181 732,237

Permits

Charges for 465,157 479,112 493,485 508,290 523,539

Service

Fines and Fees 1,795,038 1,795,038 1,795,038 1,795,038 1,795,038

Development Fees 175,492 171,982 168,542 165,171 161,868

Intragovernmental 1,666,159 1,716,144 1,767,628 1,820,657 1,875,277

Intergovernmental 3,614,845 3,723,290 3,834,989 3,950,038 4,068,540

Other Revenue 228,412 235,264 242,322 249,592 257,079

Transfers In ‐ ‐ ‐ ‐ ‐

Total Revenue $40,849,395 $41,328,677 $41,990,796 $42,974,020 $43,983,738

Expenditures

Personnel services 26,690,275 27,624,434 28,591,289 29,591,985 30,627,704

Operations & 3,109,829 3,172,026 3,235,466 3,300,175 3,366,179

maintenance

Services & other 8,536,465 8,707,194 8,881,338 9,058,965 9,240,144

Transfers to other 290,667 290,667 290,667 290,667 290,667

funds

Capital outlay ‐ ‐ ‐ ‐ ‐

Future Anticipated 5,336,500 2,203,500 3,440,500 1,798,250 1,419,025

needs

Total $43,963,735 $41,997,821 $44,439,260 $44,040,042 $44,943,719

Expenditures

Variance $(3,114,340) $(669,144) $(2,448,464) $(1,066,022) $(959,981)

Five‐Year Outlook Notes:

One‐time CIP project transfers for future years include $4,900,000 in FY 2022‐23, $687,500 in FY 2023‐24,

$1,925,000 In FY 2024‐25, and $412,500 In FY 2025‐26. The related project are listed in the Five‐Year CIP

plan.

FY 2024‐25 includes the addition of a third frontline ambulance and associated personnel with a one‐time

cost of $300,000 and on‐going expenses of $600,000. The cost has been included for budget forecasting

purposes, though actual need for a third ambulance will be based upon call volumes.

FY 2024‐25 also includes patching program of $150,000 annually and a one‐time purchase of $180,000 for

a patching truck.

Starting in FY 2020‐21, the sidewalk repair and construction project funding is increasing by 10% annually.

FY 2023‐24 anticipates issuing a CO for debt capacity demonstration purposes, which would shift property

tax from the General Fund and negatively impacts fiscal years FY 2023‐24 thru FY 2025‐26. The forecast

70