Page 68 - Microsoft Word - FY 2021 tax info sheet

P. 68

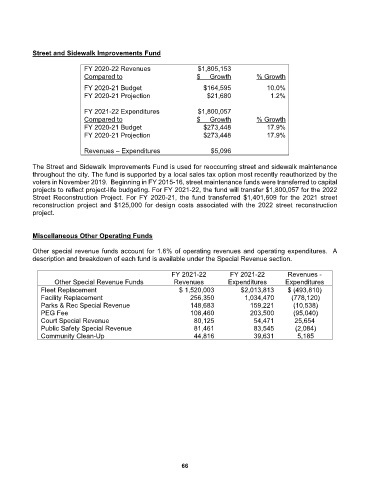

Street and Sidewalk Improvements Fund

FY 2020-22 Revenues $1,805,153

Compared to $ Growth % Growth

FY 2020-21 Budget $164,595 10.0%

FY 2020-21 Projection $21,680 1.2%

FY 2021-22 Expenditures $1,800,057

Compared to $ Growth % Growth

FY 2020-21 Budget $273,448 17.9%

FY 2020-21 Projection $273,448 17.9%

Revenues – Expenditures $5,096

The Street and Sidewalk Improvements Fund is used for reoccurring street and sidewalk maintenance

throughout the city. The fund is supported by a local sales tax option most recently reauthorized by the

voters in November 2019. Beginning in FY 2015-16, street maintenance funds were transferred to capital

projects to reflect project-life budgeting. For FY 2021-22, the fund will transfer $1,800,057 for the 2022

Street Reconstruction Project. For FY 2020-21, the fund transferred $1,401,609 for the 2021 street

reconstruction project and $125,000 for design costs associated with the 2022 street reconstruction

project.

Miscellaneous Other Operating Funds

Other special revenue funds account for 1.6% of operating revenues and operating expenditures. A

description and breakdown of each fund is available under the Special Revenue section.

FY 2021-22 FY 2021-22 Revenues -

Other Special Revenue Funds Revenues Expenditures Expenditures

Fleet Replacement $ 1,520,003 $2,013,813 $ (493,810)

Facility Replacement 256,350 1,034,470 (778,120)

Parks & Rec Special Revenue 148,683 159,221 (10,538)

PEG Fee 108,460 203,500 (95,040)

Court Special Revenue 80,125 54,471 25,654

Public Safety Special Revenue 81,461 83,545 (2,084)

Community Clean-Up 44,816 39,631 5,185

66