Page 74 - Microsoft Word - FY 2021 tax info sheet

P. 74

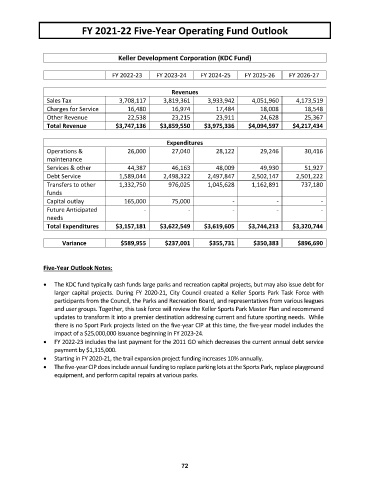

FY 2021‐22 Five‐Year Operating Fund Outlook

Keller Development Corporation (KDC Fund)

FY 2022‐23 FY 2023‐24 FY 2024‐25 FY 2025‐26 FY 2026‐27

Revenues

Sales Tax 3,708,117 3,819,361 3,933,942 4,051,960 4,173,519

Charges for Service 16,480 16,974 17,484 18,008 18,548

Other Revenue 22,538 23,215 23,911 24,628 25,367

Total Revenue $3,747,136 $3,859,550 $3,975,336 $4,094,597 $4,217,434

Expenditures

Operations & 26,000 27,040 28,122 29,246 30,416

maintenance

Services & other 44,387 46,163 48,009 49,930 51,927

Debt Service 1,589,044 2,498,322 2,497,847 2,502,147 2,501,222

Transfers to other 1,332,750 976,025 1,045,628 1,162,891 737,180

funds

Capital outlay 165,000 75,000 ‐ ‐ ‐

Future Anticipated ‐ ‐ ‐ ‐ ‐

needs

Total Expenditures $3,157,181 $3,622,549 $3,619,605 $3,744,213 $3,320,744

Variance $589,955 $237,001 $355,731 $350,383 $896,690

Five‐Year Outlook Notes:

The KDC fund typically cash funds large parks and recreation capital projects, but may also issue debt for

larger capital projects. During FY 2020‐21, City Council created a Keller Sports Park Task Force with

participants from the Council, the Parks and Recreation Board, and representatives from various leagues

and user groups. Together, this task force will review the Keller Sports Park Master Plan and recommend

updates to transform it into a premier destination addressing current and future sporting needs. While

there is no Sport Park projects listed on the five‐year CIP at this time, the five‐year model includes the

impact of a $25,000,000 issuance beginning in FY 2023‐24.

FY 2022‐23 includes the last payment for the 2011 GO which decreases the current annual debt service

payment by $1,315,000.

Starting in FY 2020‐21, the trail expansion project funding increases 10% annually.

The five‐year CIP does include annual funding to replace parking lots at the Sports Park, replace playground

equipment, and perform capital repairs at various parks.

72