Page 446 - Microsoft Word - FY 2021 tax info sheet

P. 446

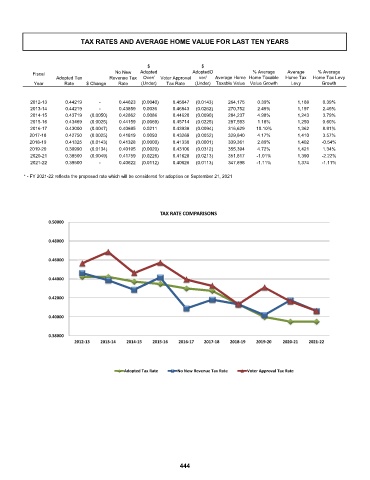

TAX RATES AND AVERAGE HOME VALUE FOR LAST TEN YEARS

$ $

Fiscal No New Adopted AdoptedO % Average Average % Average

Adopted Tax Revenue Tax Over/ Voter Approval ver/ Average Home Home Taxable Home Tax Home Tax Levy

Year Rate $ Change Rate (Under) Tax Rate (Under) Taxable Value Value Growth Levy Growth

2012-13 0.44219 - 0.44623 (0.0040) 0.45647 (0.0143) 264,175 0.39% 1,168 0.39%

2013-14 0.44219 - 0.43859 0.0036 0.46843 (0.0262) 270,752 2.49% 1,197 2.49%

2014-15 0.43719 (0.0050) 0.42862 0.0086 0.44620 (0.0090) 284,237 4.98% 1,243 3.79%

2015-16 0.43469 (0.0025) 0.44159 (0.0069) 0.45714 (0.0225) 287,593 1.18% 1,250 0.60%

2016-17 0.43000 (0.0047) 0.40885 0.0211 0.43938 (0.0094) 316,629 10.10% 1,362 8.91%

2017-18 0.42750 (0.0025) 0.41819 0.0093 0.43269 (0.0052) 329,840 4.17% 1,410 3.57%

2018-19 0.41325 (0.0143) 0.41328 (0.0000) 0.41330 (0.0001) 339,361 2.89% 1,402 -0.54%

2019-20 0.39990 (0.0134) 0.40195 (0.0020) 0.43106 (0.0312) 355,394 4.72% 1,421 1.34%

2020-21 0.39500 (0.0049) 0.41759 (0.0226) 0.41628 (0.0213) 351,817 -1.01% 1,390 -2.22%

2021-22 0.39500 - 0.40622 (0.0112) 0.40626 (0.0113) 347,898 -1.11% 1,374 -1.11%

* - FY 2021-22 reflects the proposed rate which will be considered for adoption on September 21, 2021

TAX RATE COMPARISONS

0.50000

0.48000

0.46000

0.44000

0.42000

0.40000

0.38000

2012‐13 2013‐14 2014‐15 2015‐16 2016‐17 2017‐18 2018‐19 2019‐20 2020‐21 2021‐22

Adopted Tax Rate No New Revenue Tax Rate Voter Approval Tax Rate

444