Page 333 - Microsoft Word - FY 2021 tax info sheet

P. 333

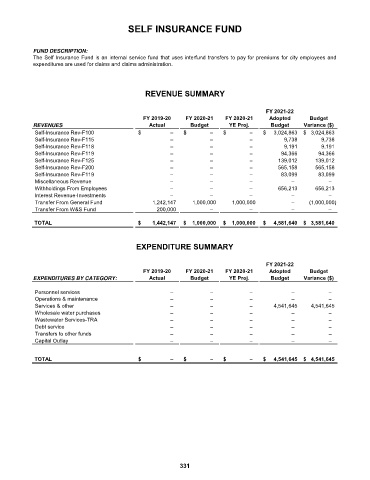

SELF INSURANCE FUND

FUND DESCRIPTION:

The Self Insurance Fund is an internal service fund that uses interfund transfers to pay for premiums for city employees and

expenditures are used for claims and claims administration.

REVENUE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Self-Insurance Rev-F100 $ – $ – $ – $ 3,024,863 $ 3,024,863

Self-Insurance Rev-F115 – – – 9,738 9,738

Self-Insurance Rev-F118 – – – 9,191 9,191

Self-Insurance Rev-F119 – – – 94,366 94,366

Self-Insurance Rev-F125 – – – 139,012 139,012

Self-Insurance Rev-F200 – – – 565,158 565,158

Self-Insurance Rev-F119 – – – 83,099 83,099

Miscellaneous Revenue – – – – –

Withholdings From Employees – – – 656,213 656,213

Interest Revenue-Investments – – – – –

Transfer From General Fund 1,242,147 1,000,000 1,000,000 – (1,000,000)

Transfer From W&S Fund 200,000 – – – –

TOTAL $ 1,442,147 $ 1,000,000 $ 1,000,000 $ 4,581,640 $ 3,581,640

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services – – – – –

Operations & maintenance – – – – –

Services & other – – – 4,541,645 4,541,645

Wholesale water purchases – – – – –

Wastewater Services-TRA – – – – –

Debt service – – – – –

Transfers to other funds – – – – –

Capital Outlay – – – – –

TOTAL $ – $ – $ – $ 4,541,645 $ 4,541,645

331