Page 326 - Microsoft Word - FY 2021 tax info sheet

P. 326

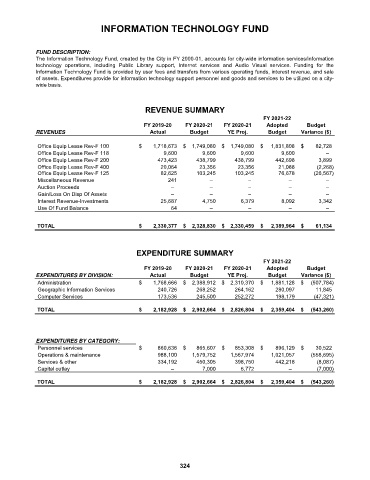

INFORMATION TECHNOLOGY FUND

FUND DESCRIPTION:

The Information Technology Fund, created by the City in FY 2000-01, accounts for city-wide information services/information

technology operations, including Public Library support, Internet services and Audio Visual services. Funding for the

Information Technology Fund is provided by user fees and transfers from various operating funds, interest revenue, and sale

of assets. Expenditures provide for information technology support personnel and goods and services to be utilized on a city-

wide basis.

REVENUE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Office Equip Lease Rev-F 100 $ 1,718,673 $ 1,749,080 $ 1,749,080 $ 1,831,808 $ 82,728

Office Equip Lease Rev-F 118 9,600 9,600 9,600 9,600 –

Office Equip Lease Rev-F 200 473,423 438,799 438,799 442,698 3,899

Office Equip Lease Rev-F 400 20,064 23,356 23,356 21,088 (2,268)

Office Equip Lease Rev-F 125 82,625 103,245 103,245 76,678 (26,567)

Miscellaneous Revenue 241 – – – –

Auction Proceeds – – – – –

Gain/Loss On Disp Of Assets – – – – –

Interest Revenue-Investments 25,687 4,750 6,379 8,092 3,342

Use Of Fund Balance 64 – – – –

TOTAL $ 2,330,377 $ 2,328,830 $ 2,330,459 $ 2,389,964 $ 61,134

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY DIVISION: Actual Budget YE Proj. Budget Variance ($)

Administration $ 1,768,666 $ 2,388,912 $ 2,310,370 $ 1,881,128 $ (507,784)

Geographic Information Services 240,726 268,252 264,162 280,097 11,845

Computer Services 173,536 245,500 252,272 198,179 (47,321)

TOTAL $ 2,182,928 $ 2,902,664 $ 2,826,804 $ 2,359,404 $ (543,260)

EXPENDITURES BY CATEGORY:

Personnel services $ 860,636 $ 865,607 $ 853,308 $ 896,129 $ 30,522

Operations & maintenance 988,100 1,579,752 1,567,974 1,021,057 (558,695)

Services & other 334,192 450,305 398,750 442,218 (8,087)

Capital outlay – 7,000 6,772 – (7,000)

TOTAL $ 2,182,928 $ 2,902,664 $ 2,826,804 $ 2,359,404 $ (543,260)

324