Page 348 - Hurst Adopted FY22 Budget

P. 348

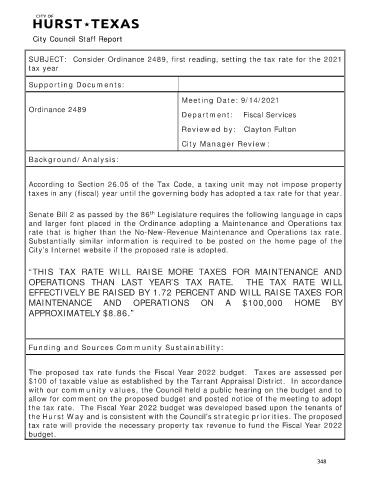

City Council Staff Report

SUBJECT: Consider Ordinance 2489, first reading, setting the tax rate for the 2021

tax year

Supporting Documents:

Meeting Date: 9/14/2021

Ordinance 2489

Department: Fiscal Services

Reviewed by: Clayton Fulton

City Manager Review:

Background/Analysis:

According to Section 26.05 of the Tax Code, a taxing unit may not impose property

taxes in any (fiscal) year until the governing body has adopted a tax rate for that year.

Senate Bill 2 as passed by the 86 Legislature requires the following language in caps

th

and larger font placed in the Ordinance adopting a Maintenance and Operations tax

rate that is higher than the No-New-Revenue Maintenance and Operations tax rate.

Substantially similar information is required to be posted on the home page of the

City’s Internet website if the proposed rate is adopted.

“THIS TAX RATE WILL RAISE MORE TAXES FOR MAINTENANCE AND

OPERATIONS THAN LAST YEAR’S TAX RATE. THE TAX RATE WILL

EFFECTIVELY BE RAISED BY 1.72 PERCENT AND WILL RAISE TAXES FOR

MAINTENANCE AND OPERATIONS ON A $100,000 HOME BY

APPROXIMATELY $8.86.”

Funding and Sources Community Sustainability:

The proposed tax rate funds the Fiscal Year 2022 budget. Taxes are assessed per

$100 of taxable value as established by the Tarrant Appraisal District. In accordance

with our community values, the Council held a public hearing on the budget and to

allow for comment on the proposed budget and posted notice of the meeting to adopt

the tax rate. The Fiscal Year 2022 budget was developed based upon the tenants of

the Hurst Way and is consistent with the Council’s strategic priorities. The proposed

tax rate will provide the necessary property tax revenue to fund the Fiscal Year 2022

budget.

348