Page 101 - Hurst Adopted FY22 Budget

P. 101

APPROVED FISCAL YEAR 2022 BUDGET

enterprise bond fund

The Revenue Bond Fund, also known as the Revenue Bond Interest and Sinking Fund, was established by

ordinance to provide for the payment of revenue bond and certificate of obligation principal and interest.

Revenue Bonds and Certificates of Obligation are a common capital resource for enterprise activities.

Revenue bond indentures contain a legal requirement that revenues derived from enterprise activity be

pledged for the repayment of debt. The same philosophy is utilized by the City for the repayment of

Certificates of Obligation debt. All existing debt includes certificates of obligation and general refunding

bonds. All debt associated with the Revenue Bond Fund is used to finance additions and repairs to the City’s

utility infrastructure such as water line and sewer main additions/replacements, water storage tanks,

and pump stations.

Every year the City's finance staff reviews market conditions and evaluates opportunities to refund, or

refinance, existing debt to achieve savings. Refunding opportunities are contingent upon current rates and

demand for municipal bonds. The last seven refunding bonds have saved the City over $6.7 million dollars

in interest costs across all bond funds. The savings are achieved through taking advantage of

lower interest rates in the municipal bond market, the City of Hurst will not pursue refundings that

extend the original maturity date of the bonds.

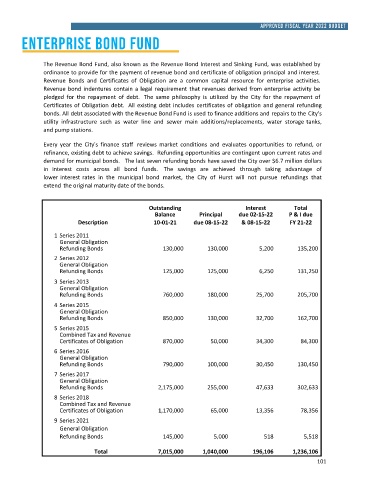

Outstanding Interest Total

Balance Principal due 02-15-22 P & I due

Description 10-01-21 due 08-15-22 & 08-15-22 FY 21-22

1 Series 2011

General Obligation

Refunding Bonds 130,000 130,000 5,200 135,200

2 Series 2012

General Obligation

Refunding Bonds 125,000 125,000 6,250 131,250

3 Series 2013

General Obligation

Refunding Bonds 760,000 180,000 25,700 205,700

4 Series 2015

General Obligation

Refunding Bonds 850,000 130,000 32,700 162,700

5 Series 2015

Combined Tax and Revenue

Certificates of Obligation 870,000 50,000 34,300 84,300

6 Series 2016

General Obligation

Refunding Bonds 790,000 100,000 30,450 130,450

7 Series 2017

General Obligation

Refunding Bonds 2,175,000 255,000 47,633 302,633

8 Series 2018

Combined Tax and Revenue

Certificates of Obligation 1,170,000 65,000 13,356 78,356

9 Series 2021

General Obligation

Refunding Bonds 145,000 5,000 518 5,518

Total 7,015,000 1,040,000 196,106 1,236,106

101