Page 254 - Grapevine FY22 Adopted Budget v2

P. 254

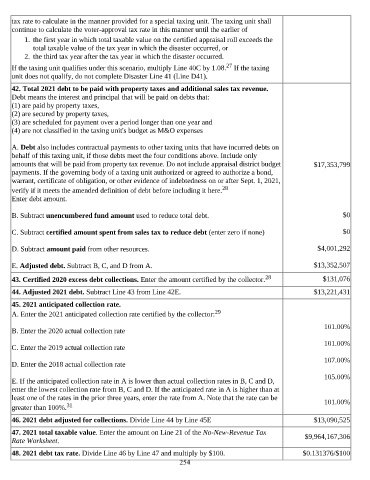

tax rate to calculate in the manner provided for a special taxing unit. The taxing unit shall

continue to calculate the voter-approval tax rate in this manner until the earlier of

1. the first year in which total taxable value on the certified appraisal roll exceeds the

total taxable value of the tax year in which the disaster occurred, or

2. the third tax year after the tax year in which the disaster occurred.

27

If the taxing unit qualifies under this scenario, multiply Line 40C by 1.08. If the taxing

unit does not qualify, do not complete Disaster Line 41 (Line D41).

42. Total 2021 debt to be paid with property taxes and additional sales tax revenue.

Debt means the interest and principal that will be paid on debts that:

(1) are paid by property taxes,

(2) are secured by property taxes,

(3) are scheduled for payment over a period longer than one year and

(4) are not classified in the taxing unit's budget as M&O expenses

A. Debt also includes contractual payments to other taxing units that have incurred debts on

behalf of this taxing unit, if those debts meet the four conditions above. Include only

amounts that will be paid from property tax revenue. Do not include appraisal district budget $17,353,799

payments. If the governing body of a taxing unit authorized or agreed to authorize a bond,

warrant, certificate of obligation, or other evidence of indebtedness on or after Sept. 1, 2021,

28

verify if it meets the amended definition of debt before including it here.

Enter debt amount.

B. Subtract unencumbered fund amount used to reduce total debt. $0

C. Subtract certified amount spent from sales tax to reduce debt (enter zero if none) $0

D. Subtract amount paid from other resources. $4,001,292

E. Adjusted debt. Subtract B, C, and D from A. $13,352,507

43. Certified 2020 excess debt collections. Enter the amount certified by the collector. 28 $131,076

44. Adjusted 2021 debt. Subtract Line 43 from Line 42E. $13,221,431

45. 2021 anticipated collection rate.

A. Enter the 2021 anticipated collection rate certified by the collector: 29

101.00%

B. Enter the 2020 actual collection rate

101.00%

C. Enter the 2019 actual collection rate

107.00%

D. Enter the 2018 actual collection rate

105.00%

E. If the anticipated collection rate in A is lower than actual collection rates in B, C and D,

enter the lowest collection rate from B, C and D. If the anticipated rate in A is higher than at

least one of the rates in the prior three years, enter the rate from A. Note that the rate can be 101.00%

greater than 100%. 31

46. 2021 debt adjusted for collections. Divide Line 44 by Line 45E $13,090,525

47. 2021 total taxable value. Enter the amount on Line 21 of the No-New-Revenue Tax $9,964,167,306

Rate Worksheet.

48. 2021 debt tax rate. Divide Line 46 by Line 47 and multiply by $100. $0.131376/$100

254