Page 259 - Grapevine FY22 Adopted Budget v2

P. 259

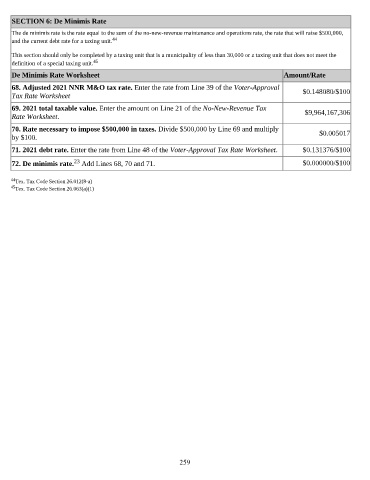

SECTION 6: De Minimis Rate

The de minimis rate is the rate equal to the sum of the no-new-revenue maintenance and operations rate, the rate that will raise $500,000,

and the current debt rate for a taxing unit. 44

This section should only be completed by a taxing unit that is a municipality of less than 30,000 or a taxing unit that does not meet the

definition of a special taxing unit. 45

De Minimis Rate Worksheet Amount/Rate

68. Adjusted 2021 NNR M&O tax rate. Enter the rate from Line 39 of the Voter-Approval $0.148080/$100

Tax Rate Worksheet

69. 2021 total taxable value. Enter the amount on Line 21 of the No-New-Revenue Tax $9,964,167,306

Rate Worksheet.

70. Rate necessary to impose $500,000 in taxes. Divide $500,000 by Line 69 and multiply $0.005017

by $100.

71. 2021 debt rate. Enter the rate from Line 48 of the Voter-Approval Tax Rate Worksheet. $0.131376/$100

23

72. De minimis rate. Add Lines 68, 70 and 71. $0.000000/$100

44 Tex. Tax Code Section 26.012(8-a)

45 Tex. Tax Code Section 26.063(a)(1)

259