Page 257 - Grapevine FY22 Adopted Budget v2

P. 257

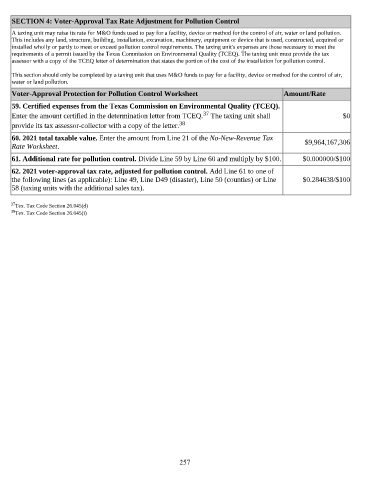

SECTION 4: Voter-Approval Tax Rate Adjustment for Pollution Control

A taxing unit may raise its rate for M&O funds used to pay for a facility, device or method for the control of air, water or land pollution.

This includes any land, structure, building, installation, excavation, machinery, equipment or device that is used, constructed, acquired or

installed wholly or partly to meet or exceed pollution control requirements. The taxing unit's expenses are those necessary to meet the

requirements of a permit issued by the Texas Commission on Environmental Quality (TCEQ). The taxing unit must provide the tax

assessor with a copy of the TCEQ letter of determination that states the portion of the cost of the installation for pollution control.

This section should only be completed by a taxing unit that uses M&O funds to pay for a facility, device or method for the control of air,

water or land pollution.

Voter-Approval Protection for Pollution Control Worksheet Amount/Rate

59. Certified expenses from the Texas Commission on Environmental Quality (TCEQ).

37

Enter the amount certified in the determination letter from TCEQ. The taxing unit shall $0

provide its tax assessor-collector with a copy of the letter. 38

60. 2021 total taxable value. Enter the amount from Line 21 of the No-New-Revenue Tax

Rate Worksheet. $9,964,167,306

61. Additional rate for pollution control. Divide Line 59 by Line 60 and multiply by $100. $0.000000/$100

62. 2021 voter-approval tax rate, adjusted for pollution control. Add Line 61 to one of

the following lines (as applicable): Line 49, Line D49 (disaster), Line 50 (counties) or Line $0.284638/$100

58 (taxing units with the additional sales tax).

37 Tex. Tax Code Section 26.045(d)

38 Tex. Tax Code Section 26.045(i)

257