Page 133 - Grapevine FY22 Adopted Budget v2

P. 133

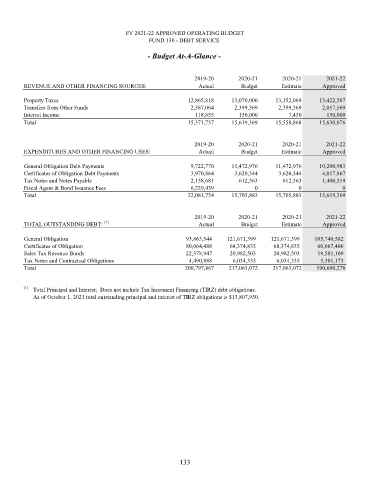

FY 2021-22 APPROVED OPERATING BUDGET

FUND 130 - DEBT SERVICE

- Budget At-A-Glance -

2019-20 2020-21 2020-21 2021-22

REVENUE AND OTHER FINANCING SOURCES: Actual Budget Estimate Approved

Property Taxes 12,865,818 13,070,000 13,152,069 13,422,507

Transfers from Other Funds 2,387,064 2,399,369 2,399,369 2,057,569

Interest Income 118,855 150,000 7,430 150,000

Total 15,371,737 15,619,369 15,558,868 15,630,076

2019-20 2020-21 2020-21 2021-22

EXPENDITURES AND OTHER FINANCING USES: Actual Budget Estimate Approved

General Obligation Debt Payments 9,722,770 11,472,976 11,472,976 10,200,983

Certificates of Obligation Debt Payments 3,970,864 3,620,344 3,620,344 4,017,867

Tax Notes and Notes Payable 2,158,681 612,563 612,563 1,400,519

Fiscal Agent & Bond Issuance Fees 6,229,439 0 0 0

Total 22,081,754 15,705,883 15,705,883 15,619,369

2019-20 2020-21 2020-21 2021-22

TOTAL OUTSTANDING DEBT: (1) Actual Budget Estimate Approved

General Obligation 93,863,544 121,671,399 121,671,399 105,740,582

Certificates of Obligation 80,064,488 68,374,835 68,374,835 60,067,406

Sales Tax Revenue Bonds 22,378,947 20,982,503 20,982,503 19,581,109

Tax Notes and Contractual Obligations 4,490,888 6,034,335 6,034,335 5,301,173

Total 200,797,867 217,063,072 217,063,072 190,690,270

(1) Total Principal and Interest; Does not include Tax Increment Financing (TIRZ) debt obligations.

As of October 1, 2021 total outstanding principal and interest of TIRZ obligations is $13,807,950.

133