Page 458 - FortWorthFY22AdoptedBudget

P. 458

B. Documentation will be retained for all bids, with the winning bid

clearly identified,

C. If for any reason the highest bid (on sales of investments) or the

lowest bid (on purchases of investments) is not selected, then the

reasons leading to that decision will be clearly documented.

7. PERFORMANCE MEASURES

The Investment Committee will meet with the Trustee or its Sub Advisor at least

annually to review portfolio performance. The Trustee or its Sub Advisor will

review results quarterly to confirm adherence to the policy guidelines; compare

the investment results with funds using similar policies and benchmarks; and

identify risks and opportunities occurring in the equity and debt markets.

The following events indicate risk to the safety and performance of the Trust.

Failure to appropriately address risk may result in termination of the Trustee or

its Sub Advisor.

A. Consistent under-performance of the stated target index for three

consecutive quarters.

B. Material changes in the managers’ organization including personnel,

ownership, acquisitions or losses of major accounts.

C. Substantial changes in basic investment philosophy.

D. Failure to observe any guidelines as stated in this policy.

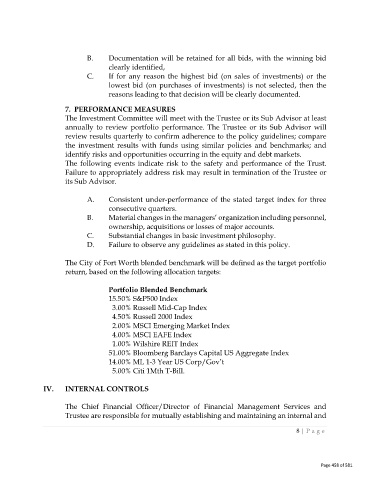

The City of Fort Worth blended benchmark will be defined as the target portfolio

return, based on the following allocation targets:

Portfolio Blended Benchmark

15.50% S&P500 Index

3.00% Russell Mid-Cap Index

4.50% Russell 2000 Index

2.00% MSCI Emerging Market Index

4.00% MSCI EAFE Index

1.00% Wilshire REIT Index

51.00% Bloomberg Barclays Capital US Aggregate Index

14.00% ML 1-3 Year US Corp/Gov’t

5.00% Citi 1Mth T-Bill.

IV. INTERNAL CONTROLS

The Chief Financial Officer/Director of Financial Management Services and

Trustee are responsible for mutually establishing and maintaining an internal and

8 | Page

Page 458 of 581