Page 456 - FortWorthFY22AdoptedBudget

P. 456

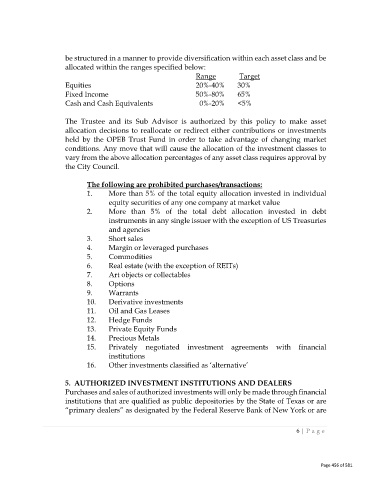

be structured in a manner to provide diversification within each asset class and be

allocated within the ranges specified below:

Range Target

Equities 20%-40% 30%

Fixed Income 50%-80% 65%

Cash and Cash Equivalents 0%-20% <5%

The Trustee and its Sub Advisor is authorized by this policy to make asset

allocation decisions to reallocate or redirect either contributions or investments

held by the OPEB Trust Fund in order to take advantage of changing market

conditions. Any move that will cause the allocation of the investment classes to

vary from the above allocation percentages of any asset class requires approval by

the City Council.

The following are prohibited purchases/transactions:

1. More than 5% of the total equity allocation invested in individual

equity securities of any one company at market value

2. More than 5% of the total debt allocation invested in debt

instruments in any single issuer with the exception of US Treasuries

and agencies

3. Short sales

4. Margin or leveraged purchases

5. Commodities

6. Real estate (with the exception of REITs)

7. Art objects or collectables

8. Options

9. Warrants

10. Derivative investments

11. Oil and Gas Leases

12. Hedge Funds

13. Private Equity Funds

14. Precious Metals

15. Privately negotiated investment agreements with financial

institutions

16. Other investments classified as ‘alternative’

5. AUTHORIZED INVESTMENT INSTITUTIONS AND DEALERS

Purchases and sales of authorized investments will only be made through financial

institutions that are qualified as public depositories by the State of Texas or are

“primary dealers” as designated by the Federal Reserve Bank of New York or are

6 | Page

Page 456 of 581