Page 46 - Forest Hill FY22 Annual Budget

P. 46

l

Fore�Hil

L

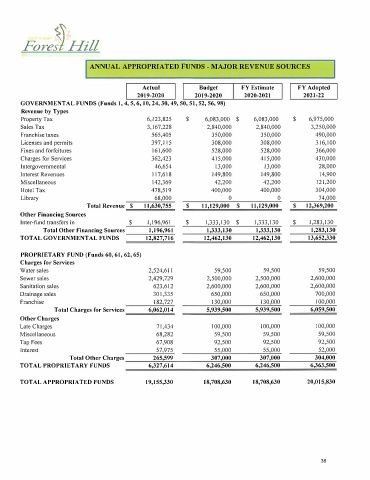

ANNUAL APPROPRIATED FUNDS - MAJOR REVENUE SOURCES

Actual Budget FY Estimate FY Adopted

2019-2020 2019-2020 2020-2021 2021-22

GOVERNMENTAL FUNDS (Funds I, 4, 5, 6, 10, 24, 30, 49, 50, 51, 52, 56, 98)

Revenue by Types

Property Tax 6,123,825 $ 6,083,000 $ 6,083,000 $ 6,975,000

Sales Tax 3,167,228 2,840,000 2,840,000 3,250,000

Franchise taxes 565,405 350,000 350,000 490,000

Licenses and permits 397,115 308,000 308,000 316,100

Fines and forfeitures 161,600 528,000 528,000 366,000

Charges for Services 362,423 415,000 415,000 430,000

Intergovernmental 46,654 13,000 13,000 28,000

Interest Revenues 117,618 149,800 149,800 14,900

Miscellaneous 142,369 42,200 42,200 121,200

Hotel Tax 478,519 400,000 400,000 304,000

Library 68,000 0 0 74,000

Total Revenue $ 11,630,755 $ 11,129,000 $ I 1,129,000 $ 12,369,200

Other Financing Sources

Inter-fund transfers in $ 1,196,961 $ 1,333,130 $ 1,333,130 $ 1,283,130

Total Other Financing Sources 1,196,961 1,333,130 1,333,130 1,283,130

TOTAL GOVERNMENTAL FUNDS 12,827,716 12,462,130 12,462,130 13,652,330

PROPRIETARY FUND (Funds 60, 61, 62, 65)

Charges for Services

Water sales 2,524,611 59,500 59,500 59,500

Sewer sales 2,429,729 2,500,000 2,500,000 2,600,000

Sanitation sales 623,612 2,600,000 2,600,000 2,600,000

Drainage sales 301,335 650,000 650,000 700,000

Franchise 182,727 130,000 130,000 100,000

Total Charges for Services 6,062,014 5,939,500 5,939,500 6,059,500

Other Charges

Late Charges 71,434 100,000 100,000 100,000

Miscellaneous 68,282 59,500 59,500 59,500

Tap Fees 67,908 92,500 92,500 92,500

Interest 57,975 55,000 55,000 52,000

Total Other Charges 265,599 307,000 307,000 304,000

TOTAL PROPRIETARY FUNDS 6,327,614 6,246,500 6,246,500 6,363,500

TOT AL APPROPRIATED FUNDS 19,155,330 18,708,630 18,708,630 20,015,830

38