Page 43 - Forest Hill FY22 Annual Budget

P. 43

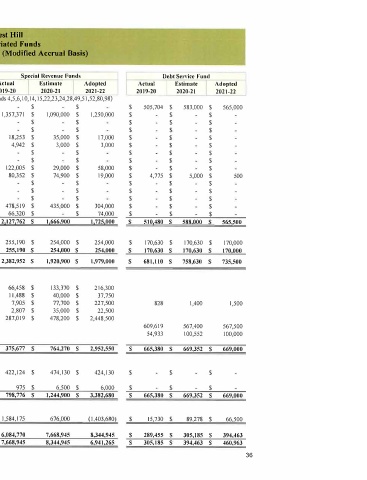

City of Forest Hill

Annual Appropriated Funds

Consolidated Funds Summary (Modified Accrual Basis)

General Fund _Special Revenue Funds Debt Sen-ice Fund

Actual -r- Estimnte Adopted Actual Estimate Adopted Actual Estimate Adopted

2019-20 2020-21 2021-22 2019-20 2020-21 2021-22 2019-20 2020-21 2021-22

Revenues: (Funds 4,5,6, I 0, 14, 15,22,23,24,28,49,51,52,80,98)

PropenyTax $ 5,618,121 $ 5,500,000 $ 6,410,000 $ $ $ $ 505,704 $ 583,000 $ 565,000

Sales Tax $ 1,809,858 $ 1,750,000 $ 1,850,000 $ 1,357,371 $ 1,090,000 $ 1,250,000 $ $ $

Franchise taxes $ 565,405 $ 350,000 $ 490,000 $ $ $ $ $ $

Licenses and permits $ 397,115 $ 308,000 $ 316,100 $ $ $ $ $ $

l'ines and forfeitures $ 143,347 $ 493,000 $ 349,000 $ 18,253 $ 35,000 $ 17,000 $ $ $

Intergovernmental $ 41,712 $ 10,000 $ 25,000 $ 4,942 $ 3,000 $ 3,000 $ $ $

Building Rental Income $ 281,716 $ 235,000 $ 280,000 $ $ $ $ $ $

Civic Center Fees $ 80,707 $ 180,000 $ 150,000 $ $ $ $ $ $

Miscellaneous $ 122,005 $ 29,000 $ 58,000 $ 122,005 $ 29,000 $ 58,000 $ $ $

Interest $ 32,487 $ 70,000 $ 5,000 $ 80,352 $ 74,900 $ 19,000 $ 4,775 $ 5,000 $ 500

Mineral rights leases/ royalties $ 18,614 $ 10,000 $ 10,000 $ $ $ $ $ $

Grant $ $ $ $ $ $ $ $ $

Donations $ 1,750 $ 3,000 $ 3,000 $ $ $ $ $ $

Hotel Tax $ $ $ 478,519 $ 435,000 $ 304,000 $ $ $

Library $ $ $ 66,320 $ $ 74,000 $ $ $

Subtotal Revenues s 9,112,837 s 8,938,000 s 9 946,IO0 2,127,762 s 1,666,900 1,725,000 s 510,480 s 588,000 s 565,500

1

Other Financing Sources:

lnterfund transfers in $ 853,494 $ 908,500 $ 908,500 $ 255,190 $ 254,000 $ 254,000 $ 170,630 $ 170,630 $ 170,000

Subtotal Other Financing Sources s 853,494 $ 908,500 s 908,500 255,190 $ 254,000 s 254,000 s 170,630 $ 170,630 $ 170,000

Total Revenues & Other Financing s 9,966,331 s 9,846,500 s s s 681,110 s

Sources 10,854,600 2,382,952 $ 1,920,900 $ 1,979,000 758,630 $ 735,500

Appropriations:

Personnel $ 6,570,928 $ 7,131,015 $ 7,051,972 $ 66,458 $ 133,370 $ 216,300

Materials/ minor equipment/ supplies $ 413,840 $ 503,600 $ 534,350 $ 11,488 $ 40,000 $ 37,750

Contractual Services $ 1,433,699 $ 1,873,450 $ 2,258,550 $ 7,905 $ 77,700 $ 227,500 828 1,400 1,500

Training & Travel $ 89,613 $ 94,550 $ 134,250 $ 2,807 $ 35,000 $ 22,500

Capital lease payments $ 699,727 $ 647,600 $ 786,500 $ 287,019 $ 478,200 $ 2,448,500

Debt service principal 609,619 567,400 567,500

Debt service interest 54,933 100,552 100,000

Capital Outlay

Subtotal Appropriations s 9,207,807 s 10,250,215 s I0,765,622 375,677 $ 764,270 s 2,952,550 s 665,380 s 669,352 $ 669,000

Other Financing Uses:

lnterfund transfers out $ 269,941 $ 254,000 $ 254,000 $ 422,124 $ 474,130 $ 424,130 $ $ $

Debt issuance cost

Miscellaneous Uses $ 61,604 $ 60,650 $ 74,400 $ 975 $ 6,500 $ 6,000 $ $ $

Total Appropriations: s 9,539,352 s 10,564,865 s 11,094,022 s 798,776 s 1,244,900 $ 3,382,680 s 665,380 s 669,352 s 669,000

Net Increase (Decrease) in Fund

Balance $ 426,979 $ (718,365) $ (239,422) 1,584,175 676,000 (1,403,680) $ 15,730 $ 89,278 $ 66.500

Accrual adjustment for GAAP

Beginning Budgetary Fund Balance s 2,334,168 s 2,761,147 s 2,042,782 s 6,084,770 7,668,945 8,344,945 $ 289,455 s 305,185 $ 394,463

Ending Budgetary Fund Balance s 2,761,147 $ 2,042,782 s 1,803,360 7,668,945 8,344,945 6,941,265 s 305,185 s 394,463 s 460,963

36