Page 51 - Watauga FY21 Budget

P. 51

BUDGET OVERVIEW

The top ten principal taxpayers in the City include:

NAME TYPE OF NET TAXABLE % OF TOTAL

BUSINESS/PROPERTY ASSESSED VALUE ASSESSED TAXABLE

VALUE

Inland Western Shopping Mall $35,899,769 2.25%

Watauga Towne Retail Center $33,423,726 2.09%

ParkVista Townhomes Apartments $15,900,000 1.00%

Brookwillow Retail Center $14,020,822 0.88%

Dayton Hudson Retail $ 9,633,051 0.60%

Oncor Electric Electric Utility $ 8,779,314 0.55%

Watauga Assoc. Retail $ 5,717,674 0.37%

Woodcrest Retail $ 5,700,000 0.36%

Target Retail $ 5,642,632 0.35%

Southwestern Bell Utility $ 5,015,504 0.31%

TOP TEN TOTAL % OF CITY’S ASSESSED VALUATION: 8.76%

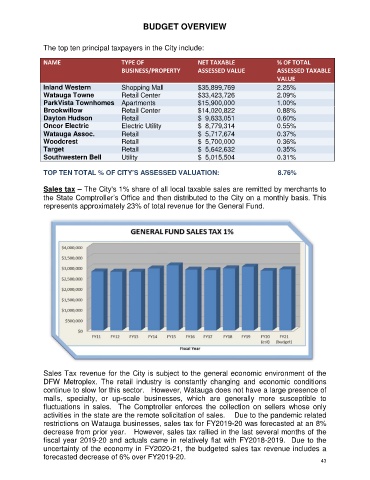

Sales tax – The City's 1% share of all local taxable sales are remitted by merchants to

the State Comptroller’s Office and then distributed to the City on a monthly basis. This

represents approximately 23% of total revenue for the General Fund.

Sales Tax revenue for the City is subject to the general economic environment of the

DFW Metroplex. The retail industry is constantly changing and economic conditions

continue to slow for this sector. However, Watauga does not have a large presence of

malls, specialty, or up-scale businesses, which are generally more susceptible to

fluctuations in sales. The Comptroller enforces the collection on sellers whose only

activities in the state are the remote solicitation of sales. Due to the pandemic related

restrictions on Watauga businesses, sales tax for FY2019-20 was forecasted at an 8%

decrease from prior year. However, sales tax rallied in the last several months of the

fiscal year 2019-20 and actuals came in relatively flat with FY2018-2019. Due to the

uncertainty of the economy in FY2020-21, the budgeted sales tax revenue includes a

forecasted decrease of 6% over FY2019-20.

43