Page 49 - Watauga FY21 Budget

P. 49

BUDGET OVERVIEW

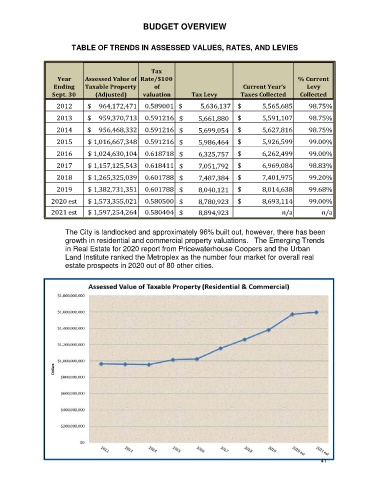

TABLE OF TRENDS IN ASSESSED VALUES, RATES, AND LEVIES

Tax

Year Assessed Value of Rate/$100 % Current

Ending Taxable Property of Current Year's Levy

Sept. 30 (Adjusted) valuation Tax Levy Taxes Collected Collected

2012 $ 964,172,471 0.589001 $ 5,636,137 $ 5,565,685 98.75%

2013 $ 959,370,713 0.591216 $ 5,661,880 $ 5,591,107 98.75%

2014 $ 956,468,332 0.591216 $ 5,699,054 $ 5,627,816 98.75%

2015 $ 1,016,667,348 0.591216 $ 5,986,464 $ 5,926,599 99.00%

2016 $ 1,024,630,104 0.618718 $ 6,325,757 $ 6,262,499 99.00%

2017 $ 1,157,125,543 0.618411 $ 7,051,792 $ 6,969,084 98.83%

2018 $ 1,265,325,039 0.601788 $ 7,487,384 $ 7,401,975 99.20%

2019 $ 1,382,731,351 0.601788 $ 8,040,121 $ 8,014,638 99.68%

2020 est $ 1,573,355,021 0.580500 $ 8,780,923 $ 8,693,114 99.00%

2021 est $ 1,597,254,264 0.580404 $ 8,894,923 n/a n/a

The City is landlocked and approximately 96% built out, however, there has been

growth in residential and commercial property valuations. The Emerging Trends

in Real Estate for 2020 report from Pricewaterhouse Coopers and the Urban

Land Institute ranked the Metroplex as the number four market for overall real

estate prospects in 2020 out of 80 other cities.

41