Page 48 - Watauga FY21 Budget

P. 48

BUDGET OVERVIEW

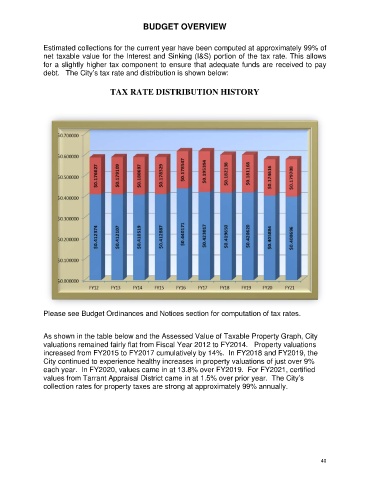

Estimated collections for the current year have been computed at approximately 99% of

net taxable value for the Interest and Sinking (I&S) portion of the tax rate. This allows

for a slightly higher tax component to ensure that adequate funds are received to pay

debt. The City’s tax rate and distribution is shown below:

TAX RATE DISTRIBUTION HISTORY

Please see Budget Ordinances and Notices section for computation of tax rates.

As shown in the table below and the Assessed Value of Taxable Property Graph, City

valuations remained fairly flat from Fiscal Year 2012 to FY2014. Property valuations

increased from FY2015 to FY2017 cumulatively by 14%. In FY2018 and FY2019, the

City continued to experience healthy increases in property valuations of just over 9%

each year. In FY2020, values came in at 13.8% over FY2019. For FY2021, certified

values from Tarrant Appraisal District came in at 1.5% over prior year. The City’s

collection rates for property taxes are strong at approximately 99% annually.

40