Page 56 - Watauga FY21 Budget

P. 56

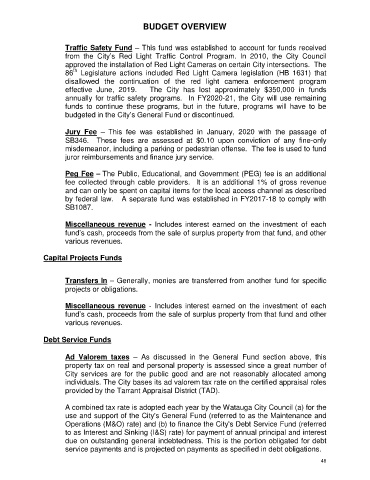

BUDGET OVERVIEW

Traffic Safety Fund – This fund was established to account for funds received

from the City’s Red Light Traffic Control Program. In 2010, the City Council

approved the installation of Red Light Cameras on certain City intersections. The

th

86 Legislature actions included Red Light Camera legislation (HB 1631) that

disallowed the continuation of the red light camera enforcement program

effective June, 2019. The City has lost approximately $350,000 in funds

annually for traffic safety programs. In FY2020-21, the City will use remaining

funds to continue these programs, but in the future, programs will have to be

budgeted in the City’s General Fund or discontinued.

Jury Fee – This fee was established in January, 2020 with the passage of

SB346. These fees are assessed at $0.10 upon conviction of any fine-only

misdemeanor, including a parking or pedestrian offense. The fee is used to fund

juror reimbursements and finance jury service.

Peg Fee – The Public, Educational, and Government (PEG) fee is an additional

fee collected through cable providers. It is an additional 1% of gross revenue

and can only be spent on capital items for the local access channel as described

by federal law. A separate fund was established in FY2017-18 to comply with

SB1087.

Miscellaneous revenue - Includes interest earned on the investment of each

fund’s cash, proceeds from the sale of surplus property from that fund, and other

various revenues.

Capital Projects Funds

Transfers In – Generally, monies are transferred from another fund for specific

projects or obligations.

Miscellaneous revenue - Includes interest earned on the investment of each

fund’s cash, proceeds from the sale of surplus property from that fund and other

various revenues.

Debt Service Funds

Ad Valorem taxes – As discussed in the General Fund section above, this

property tax on real and personal property is assessed since a great number of

City services are for the public good and are not reasonably allocated among

individuals. The City bases its ad valorem tax rate on the certified appraisal roles

provided by the Tarrant Appraisal District (TAD).

A combined tax rate is adopted each year by the Watauga City Council (a) for the

use and support of the City's General Fund (referred to as the Maintenance and

Operations (M&O) rate) and (b) to finance the City's Debt Service Fund (referred

to as Interest and Sinking (I&S) rate) for payment of annual principal and interest

due on outstanding general indebtedness. This is the portion obligated for debt

service payments and is projected on payments as specified in debt obligations.

48