Page 299 - Watauga FY21 Budget

P. 299

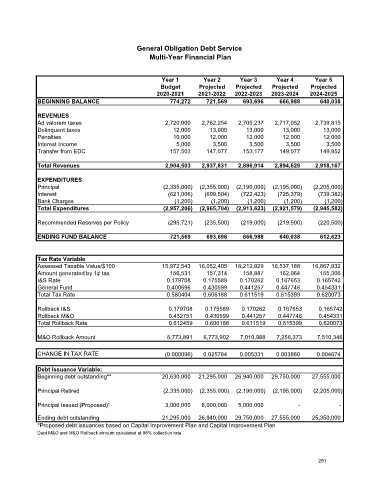

General Obligation Debt Service

Multi-Year Financial Plan

Year 1 Year 2 Year 3 Year 4 Year 5

Budget Projected Projected Projected Projected

2020-2021 2021-2022 2022-2023 2023-2024 2024-2025

BEGINNING BALANCE 774,272 721,569 693,696 666,988 640,038

REVENUES

Ad valorem taxes 2,720,000 2,762,254 2,705,237 2,717,052 2,739,815

Delinquent taxes 12,000 13,000 13,000 13,000 13,000

Penalties 10,000 12,000 12,000 12,000 12,000

Interest Income 5,000 3,500 3,500 3,500 3,500

Transfer from EDC 157,503 147,077 153,177 149,077 149,852

Total Revenues 2,904,503 2,937,831 2,886,914 2,894,629 2,918,167

EXPENDITURES

Principal (2,335,000) (2,355,000) (2,190,000) (2,195,000) (2,205,000)

Interest (621,006) (609,504) (722,423) (725,379) (739,382)

Bank Charges (1,200) (1,200) (1,200) (1,200) (1,200)

Total Expenditures (2,957,206) (2,965,704) (2,913,623) (2,921,579) (2,945,582)

Recommended Reserves per Policy (295,721) (235,500) (219,000) (219,500) (220,500)

ENDING FUND BALANCE 721,569 693,696 666,988 640,038 612,623

Tax Rate Variable

Assessed Taxable Value/$100 15,972,543 16,052,405 16,212,929 16,537,188 16,867,932

Amount generated by 1¢ tax 156,531 157,314 158,887 162,064 165,306

I&S Rate 0.179708 0.175589 0.170262 0.167653 0.165742

General Fund 0.400696 0.430599 0.441257 0.447746 0.454331

Total Tax Rate 0.580404 0.606188 0.611519 0.615399 0.620073

Rollback I&S 0.179708 0.175589 0.170262 0.167653 0.165742

Rollback M&O 0.432751 0.430599 0.441257 0.447746 0.454331

Total Rollback Rate 0.612459 0.606188 0.611519 0.615399 0.620073

M&O Rollback Amount 6,773,891 6,773,902 7,010,988 7,256,373 7,510,346

CHANGE IN TAX RATE (0.000096) 0.025784 0.005331 0.003880 0.004674

Debt Issuance Variable:

Beginning debt outstanding** 20,630,000 21,295,000 26,940,000 29,750,000 27,555,000

Principal Retired (2,335,000) (2,355,000) (2,190,000) (2,195,000) (2,205,000)

Principal Issued (Proposed)* 3,000,000 8,000,000 5,000,000 - -

Ending debt outstanding 21,295,000 26,940,000 29,750,000 27,555,000 25,350,000

*Proposed debt issuances based on Capital Improvement Plan and Capital Improvement Plan

Debt M&O and M&O Rollback amount calculated at 98% collection rate

291