Page 296 - Watauga FY21 Budget

P. 296

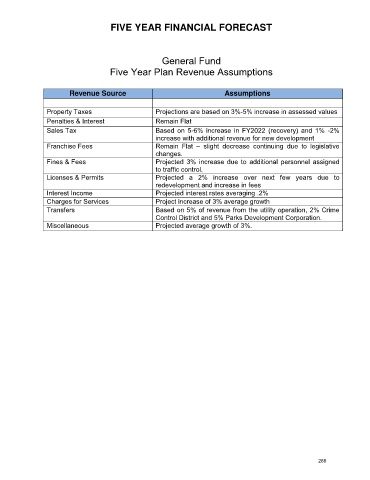

FIVE YEAR FINANCIAL FORECAST

General Fund

Five Year Plan Revenue Assumptions

Revenue Source Assumptions

Property Taxes Projections are based on 3%-5% increase in assessed values

Penalties & Interest Remain Flat

Sales Tax Based on 5-6% increase in FY2022 (recovery) and 1% -2%

increase with additional revenue for new development

Franchise Fees Remain Flat – slight decrease continuing due to legislative

changes.

Fines & Fees Projected 3% increase due to additional personnel assigned

to traffic control.

Licenses & Permits Projected a 2% increase over next few years due to

redevelopment and increase in fees

Interest Income Projected interest rates averaging .2%

Charges for Services Project increase of 3% average growth

Transfers Based on 5% of revenue from the utility operation, 2% Crime

Control District and 5% Parks Development Corporation.

Miscellaneous Projected average growth of 3%.

288