Page 297 - Watauga FY21 Budget

P. 297

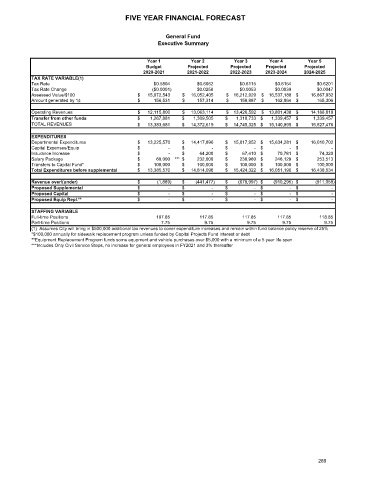

FIVE YEAR FINANCIAL FORECAST

General Fund

Executive Summary

Year 1 Year 2 Year 3 Year 4 Year 5

Budget Projected Projected Projected Projected

2020-2021 2021-2022 2022-2023 2023-2024 2024-2025

TAX RATE VARIABLE(1)

Tax Rate $0.5804 $0.6062 $0.6115 $0.6154 $0.6201

Tax Rate Change ($0.0001) $0.0258 $0.0053 $0.0039 $0.0047

Assessed Value/$100 $ 15,972,543 $ 16,052,405 $ 16,212,929 $ 16,537,188 $ 16,867,932

Amount generated by 1¢ $ 156,531 $ 157,314 $ 158,887 $ 162,064 $ 165,306

Operating Revenues $ 12,115,800 $ 13,063,114 $ 13,426,592 $ 13,801,438 $ 14,188,019

Transfer from other funds $ 1,267,881 $ 1,309,505 $ 1,318,733 $ 1,339,457 $ 1,339,457

TOTAL REVENUES $ 13,383,681 $ 14,372,619 $ 14,745,325 $ 15,140,895 $ 15,527,476

EXPENDITURES

Departmental Expenditures $ 13,225,570 $ 14,417,896 $ 15,017,952 $ 15,634,281 $ 16,010,702

Capital Expenses/Equip $ - $ - $ - $ - $ -

Insurance Increase $ - $ 64,200 $ 67,410 $ 70,781 $ 74,320

Salary Package $ 60,000 *** $ 232,000 $ 238,960 $ 246,129 $ 253,513

Transfers to Capital Fund* $ 100,000 $ 100,000 $ 100,000 $ 100,000 $ 100,000

Total Expenditures before supplemental $ 13,385,570 $ 14,814,096 $ 15,424,322 $ 16,051,190 $ 16,438,534

Revenue over/(under) $ (1,889) $ (441,477) $ (678,997) $ (910,295) $ (911,058)

Proposed Supplemental $ - $ - $ - $ - $ -

Proposed Capital $ - $ - $ - $ - $ -

Proposed Equip Repl.** $ - $ - $ - $ - $ -

STAFFING VARIABLE

Full-time Positions 107.85 117.85 117.85 117.85 118.85

Part-time Positions 7.75 9.75 9.75 9.75 9.75

(1) Assumes City will bring in $500,000 additional tax revenues to cover expenditure increases and remain within fund balance policy reserve of 25%

*$100,000 annually for sidewalk replacement program unless funded by Capital Projects Fund interest or debt

**Equipment Replacement Program funds some equpment and vehicle purchases over $5,000 with a minimum of a 5 year life span

***Includes Only Civil Service Steps, no increase for general employees in FY2021 and 3% thereafter

289