Page 46 - N. Richland Hills General Budget

P. 46

BUDGET OVERVIEW

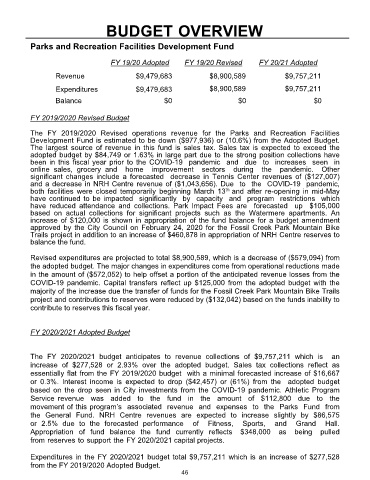

Parks and Recreation Facilities Development Fund

FY 19/20 Adopted FY 19/20 Revised FY 20/21 Adopted

Revenue $9,479,683 $8,900,589 $9,757,211

Expenditures $9,479,683 $8,900,589 $9,757,211

Balance $0 $0 $0

FY 2019/2020 Revised Budget

The FY 2019/2020 Revised operations revenue for the Parks and Recreation Facilities

Development Fund is estimated to be down ($977,936) or (10.6%) from the Adopted Budget.

The largest source of revenue in this fund is sales tax. Sales tax is expected to exceed the

adopted budget by $84,749 or 1.63% in large part due to the strong position collections have

been in this fiscal year prior to the COVID-19 pandemic and due to increases seen in

online sales, grocery and home improvement sectors during the pandemic. Other

significant changes include a forecasted decrease in Tennis Center revenues of ($127,007)

and a decrease in NRH Centre revenue of ($1,043,656). Due to the COVID-19 pandemic,

th

both facilities were closed temporarily beginning March 13 and after re-opening in mid-May

have continued to be impacted significantly by capacity and program restrictions which

have reduced attendance and collections. Park Impact Fees are forecasted up $105,000

based on actual collections for significant projects such as the Watermere apartments. An

increase of $120,000 is shown in appropriation of the fund balance for a budget amendment

approved by the City Council on February 24, 2020 for the Fossil Creek Park Mountain Bike

Trails project in addition to an increase of $460,878 in appropriation of NRH Centre reserves to

balance the fund.

Revised expenditures are projected to total $8,900,589, which is a decrease of ($579,094) from

the adopted budget. The major changes in expenditures come from operational reductions made

in the amount of ($572,052) to help offset a portion of the anticipated revenue losses from the

COVID-19 pandemic. Capital transfers reflect up $125,000 from the adopted budget with the

majority of the increase due the transfer of funds for the Fossil Creek Park Mountain Bike Trails

project and contributions to reserves were reduced by ($132,042) based on the funds inability to

contribute to reserves this fiscal year.

FY 2020/2021 Adopted Budget

The FY 2020/2021 budget anticipates to revenue collections of $9,757,211 which is an

increase of $277,528 or 2.93% over the adopted budget. Sales tax collections reflect as

essentially flat from the FY 2019/2020 budget with a minimal forecasted increase of $16,667

or 0.3%. Interest income is expected to drop ($42,457) or (61%) from the adopted budget

based on the drop seen in City investments from the COVID-19 pandemic. Athletic Program

Service revenue was added to the fund in the amount of $112,800 due to the

movement of this program’s associated revenue and expenses to the Parks Fund from

the General Fund. NRH Centre revenues are expected to increase slightly by $86,575

or 2.5% due to the forecasted performance of Fitness, Sports, and Grand Hall.

Appropriation of fund balance the fund currently reflects $348,000 as being pulled

from reserves to support the FY 2020/2021 capital projects.

Expenditures in the FY 2020/2021 budget total $9,757,211 which is an increase of $277,528

from the FY 2019/2020 Adopted Budget.

46