Page 41 - N. Richland Hills General Budget

P. 41

BUDGET OVERVIEW

FY 2019/2020 REVISED & FY 2020/2021 ADOPTED BUDGET

HIGHLIGHTS

As part of the regular annual budget process, some areas of the FY 2019/2020 budget

require revision from the originally adopted level. Projecting revenues and expenditures can be

difficult because they are being predicted up to fourteen months before they occur. Revenues

and expenditures are tracked throughout the year and adjustments are made to the Adopted

Budget in order to complete the fiscal year.

General Fund FY 2019/2020 Revised Budget

Revenue Overview

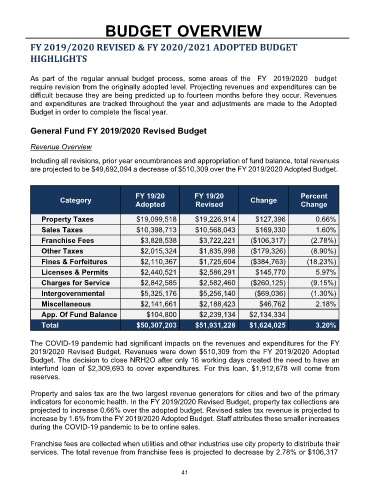

Including all revisions, prior year encumbrances and appropriation of fund balance, total revenues

are projected to be $49,692,094 a decrease of $510,309 over the FY 2019/2020 Adopted Budget.

FY 19/20 FY 19/20 Percent

Category Change

Adopted Revised Change

Property Taxes $19,099,518 $19,226,914 $127,396 0.66%

Sales Taxes $10,398,713 $10,568,043 $169,330 1.60%

Franchise Fees $3,828,538 $3,722,221 ($106,317) (2.78%)

Other Taxes $2,015,324 $1,835,998 ($179,326) (8.90%)

Fines & Forfeitures $2,110,367 $1,725,604 ($384,763) (18.23%)

Licenses & Permits $2,440,521 $2,586,291 $145,770 5.97%

Charges for Service $2,842,585 $2,582,460 ($260,125) (9.15%)

Intergovernmental $5,325,176 $5,256,140 ($69,036) (1.30%)

Miscellaneous $2,141,661 $2,188,423 $46,762 2.18%

App. Of Fund Balance $104,800 $2,239,134 $2,134,334

Total $50,307,203 $51,931,228 $1,624,025 3.20%

The COVID-19 pandemic had significant impacts on the revenues and expenditures for the FY

2019/2020 Revised Budget. Revenues were down $510,309 from the FY 2019/2020 Adopted

Budget. The decision to close NRH2O after only 16 working days created the need to have an

interfund loan of $2,309,693 to cover expenditures. For this loan, $1,912,678 will come from

reserves.

Property and sales tax are the two largest revenue generators for cities and two of the primary

indicators for economic health. In the FY 2019/2020 Revised Budget, property tax collections are

projected to increase 0.66% over the adopted budget. Revised sales tax revenue is projected to

increase by 1.6% from the FY 2019/2020 Adopted Budget. Staff attributes these smaller increases

during the COVID-19 pandemic to be to online sales.

Franchise fees are collected when utilities and other industries use city property to distribute their

services. The total revenue from franchise fees is projected to decrease by 2.78% or $106,317

41