Page 43 - N. Richland Hills General Budget

P. 43

BUDGET OVERVIEW

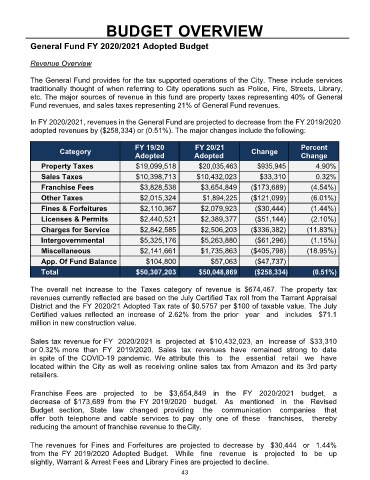

General Fund FY 2020/2021 Adopted Budget

Revenue Overview

The General Fund provides for the tax supported operations of the City. These include services

traditionally thought of when referring to City operations such as Police, Fire, Streets, Library,

etc. The major sources of revenue in this fund are property taxes representing 40% of General

Fund revenues, and sales taxes representing 21% of General Fund revenues.

In FY 2020/2021, revenues in the General Fund are projected to decrease from the FY 2019/2020

adopted revenues by ($258,334) or (0.51%). The major changes include the following:

FY 19/20 FY 20/21 Percent

Category Change

Adopted Adopted Change

Property Taxes $19,099,518 $20,035,463 $935,945 4.90%

Sales Taxes $10,398,713 $10,432,023 $33,310 0.32%

Franchise Fees $3,828,538 $3,654,849 ($173,689) (4.54%)

Other Taxes $2,015,324 $1,894,225 ($121,099) (6.01%)

Fines & Forfeitures $2,110,367 $2,079,923 ($30,444) (1.44%)

Licenses & Permits $2,440,521 $2,389,377 ($51,144) (2.10%)

Charges for Service $2,842,585 $2,506,203 ($336,382) (11.83%)

Intergovernmental $5,325,176 $5,263,880 ($61,296) (1.15%)

Miscellaneous $2,141,661 $1,735,863 ($405,798) (18.95%)

App. Of Fund Balance $104,800 $57,063 ($47,737)

Total $50,307,203 $50,048,869 ($258,334) (0.51%)

The overall net increase to the Taxes category of revenue is $674,467. The property tax

revenues currently reflected are based on the July Certified Tax roll from the Tarrant Appraisal

District and the FY 2020/21 Adopted Tax rate of $0.5757 per $100 of taxable value. The July

Certified values reflected an increase of 2.62% from the prior year and includes $71.1

million in new construction value.

Sales tax revenue for FY 2020/2021 is projected at $10,432,023, an increase of $33,310

or 0.32% more than FY 2019/2020. Sales tax revenues have remained strong to date

in spite of the COVID-19 pandemic. We attribute this to the essential retail we have

located within the City as well as receiving online sales tax from Amazon and its 3rd party

retailers.

Franchise Fees are projected to be $3,654,849 in the FY 2020/2021 budget, a

decrease of $173,689 from the FY 2019/2020 budget. As mentioned in the Revised

Budget section, State law changed providing the communication companies that

offer both telephone and cable services to pay only one of these franchises, thereby

reducing the amount of franchise revenue to the City.

The revenues for Fines and Forfeitures are projected to decrease by $30,444 or 1.44%

from the FY 2019/2020 Adopted Budget. While fine revenue is projected to be up

slightly, Warrant & Arrest Fees and Library Fines are projected to decline.

43