Page 114 - N. Richland Hills General Budget

P. 114

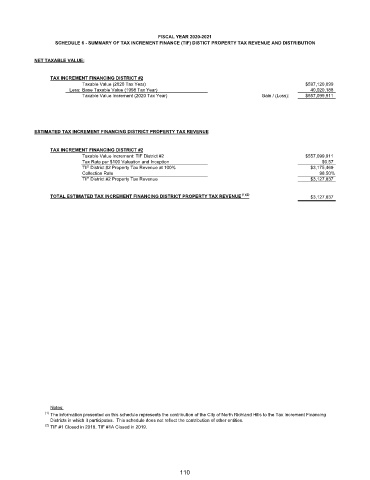

FISCAL YEAR 2020-2021

SCHEDULE 6 - SUMMARY OF TAX INCREMENT FINANCE (TIF) DISTICT PROPERTY TAX REVENUE AND DISTRIBUTION

NET TAXABLE VALUE:

TAX INCREMENT FINANCING DISTRICT #2

Taxable Value (2020 Tax Year) $597,120,099

Less: Base Taxable Value (1998 Tax Year) 40,020,188

Taxable Value Increment (2020 Tax Year) Gain / (Loss): $557,099,911

ESTIMATED TAX INCREMENT FINANCING DISTRICT PROPERTY TAX REVENUE

TAX INCREMENT FINANCING DISTRICT #2

Taxable Value Increment: TIF District #2 $557,099,911

Tax Rate per $100 Valuation and Inception $0.57

TIF District #2 Property Tax Revenue at 100% $3,175,469

Collection Rate 98.50%

TIF District #2 Property Tax Revenue $3,127,837

TOTAL ESTIMATED TAX INCREMENT FINANCING DISTRICT PROPERTY TAX REVENUE (1)(2) $3,127,837

Notes:

(1)

The information presented on this schedule represents the contribution of the City of North Richland Hills to the Tax Increment Financing

Districts in which it participates. This schedule does not reflect the contribution of other entities.

(2)

TIF #1 Closed in 2018. TIF #1A Closed in 2019.

110