Page 113 - N. Richland Hills General Budget

P. 113

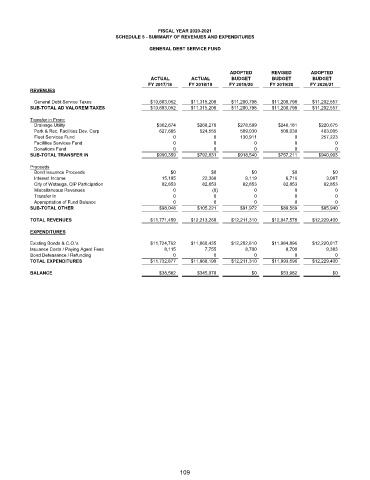

FISCAL YEAR 2020-2021

SCHEDULE 5 - SUMMARY OF REVENUES AND EXPENDITURES

GENERAL DEBT SERVICE FUND

ADOPTED REVISED ADOPTED

ACTUAL ACTUAL BUDGET BUDGET BUDGET

FY 2017/18 FY 2018/19 FY 2019/20 FY 2019/20 FY 2020/21

REVENUES

General Debt Service Taxes $10,683,052 $11,315,208 $11,200,798 $11,200,798 $11,202,557

SUB-TOTAL AD VALOREM TAXES $10,683,052 $11,315,208 $11,200,798 $11,200,798 $11,202,557

Transfer in From:

Drainage Utility $362,674 $268,276 $278,599 $248,181 $220,675

Park & Rec. Facilities Dev. Corp 627,685 524,555 509,030 509,030 463,005

Fleet Services Fund 0 0 130,911 0 257,223

Facilities Services Fund 0 0 0 0 0

Donations Fund 0 0 0 0 0

SUB-TOTAL TRANSFER IN $990,359 $792,831 $918,540 $757,211 $940,903

Proceeds

Bond Issuance Proceeds $0 $0 $0 $0 $0

Interest Income 15,195 22,368 9,119 6,716 3,087

City of Watauga, CIP Participation 82,853 82,853 82,853 82,853 82,853

Miscellaneous Revenues 0 (0) 0 0 0

Transfer In 0 0 0 0 0

Appropriation of Fund Balance 0 0 0 0 0

SUB-TOTAL OTHER $98,048 $105,221 $91,972 $89,569 $85,940

TOTAL REVENUES $11,771,459 $12,213,260 $12,211,310 $12,047,578 $12,229,400

EXPENDITURES

Existing Bonds & C.O.'s $11,724,762 $11,860,435 $12,202,610 $11,984,896 $12,220,017

Issuance Costs / Paying Agent Fees 8,115 7,755 8,700 8,700 9,383

Bond Defeasance / Refunding 0 0 0 0 0

TOTAL EXPENDITURES $11,732,877 $11,868,190 $12,211,310 $11,993,596 $12,229,400

BALANCE $38,582 $345,070 $0 $53,982 $0

109