Page 41 - Forest Hill FY21 Annual Budget

P. 41

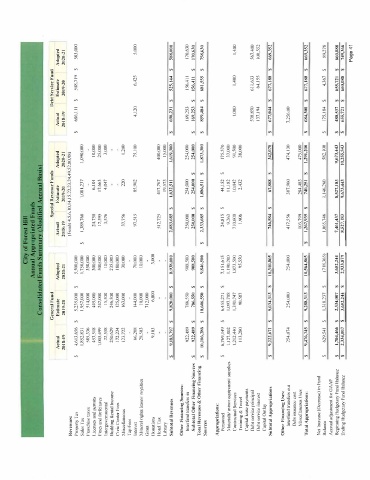

City of Forest Hill

Annual Appropriated Funds

Consolidated Funds Summan: (ModifiedA££rual ,Basis}

General Fund ' Special Revenue Funds Debt Service Fund

Actual Estimate AdoptNI Actual Estimate Adopted Actual Estim:,te Adopted

2018-19 2019-20 2020-21 2018-19 2019-20 2020-21 2018-19 2019-20 2020-21

Revenues: (Funds 4,5.C,. I0, 14, I 5,22.23.24,49.52.80,98)

Propcny Tax s 4.6 I 3.656 s 5.235,000 s 5.500,000 s 686.111 s 518.719 s 583.000

Sales Tax 1,852,831 1,957,000 1,750,000 s 1,389,760 1,081,237 1,090.000

Franchise taxes 585,336 514.000 350,000

Licenses and pcnnits 453,518 445,000 300,000 24.758 6.101 10,000

Fines and forl.:itures 1.005.499 247,000 500,000 17,595 17.663 25.000

lnh:rgovcnunental 22.558 15,500 10,000 3,576 4.047 3,000

Building Rental lncomc 250.629 246.500 235,000

Civic Center Fces 172.234 125,000 180.000

Miscdlancous 123,722 163.000 30.000 37.756 220 1.200

Tap Fet:s

Interest 66.208 144.000 70.000 97.515 85.902 75.100 4.120 6.425 5.000

Mincrnl ,ights leases/ royalties 28.503 10,000 10,000

G10111t 712,000

Donations 9,103 6.000 3.000

llotd Tax 512.725 417.767 400.000

Libr:uy 19,573 15.000

Suhtotal Revenues $ 'J,IX3,7'>7 $ 9,HZ0,000 s 8,'>38.U0U 2.083.685 $ 1.632.511 l,61'>.300 s 690,231 s 525,1-14 $ 588.000

Other Financing Sources:

lntcrfimd translcr.; in 922.489 786,550 908,500 250,000 254,000 254,000 169.253 156,411 170.630

Subtotal Other Fin:111cing Sources s 922.-189 $ 7X6,550 s 908.500 250,000 s 25-1,000 s 25-1.000 s 169.253 s 156.-111 s 170,630

Total Revenues & Other Financing $ 10,106,286 $ 10,606,550 s 9,8-16,500 s 2,333,685 s 1,886,511 $ 1,873,300 s 859,-184 $ 681,555 s 758,630

Sources

A 1 1propriations:

l'crsonncl s 6,769,149 s 6.455.271 s 7,151,615 24,815 s 44,152 s 175,570

Materials/ minor cquipmcnt/ supplies I, 127.802 1,097,708 1.190.200 9.263 11. I 82 37.000

Con11�1ctual Services 1,212,440 1,390.747 1.873.500 710,600 I0,042 91,500 1.000 1,400 1,400

Trnining & T101vel 113,280 90.587 95,550 1,906 2,432 38.000

Capital lease payments

Debt service principal 538,850 611,633 567.400

Debt service i111ercst 137.194 64.155 100.552

Capital Outlay

Subtotal AJ>propriations $ 9,222,671 $ '),03-l,3J_:3_J I 0.3 I o_,865 �58-1 $ 67,lWH s _ 3_-12,070 $ 677,0-1-1 $ 677,188 $ 669,352

Other Financing Uses:

l111crfimd trnnsli:rs out 254.074 254.000 254.000 417.556 387.960 474.130 7,256.00

Debt issuance cost

Miscellaneous Uses 103,799 284,483 475.000

Total Appropriations: $ 9,476,745 $ 'J,28X,J 13 _ $ 10,56,1,!65 $ 1,267,939 $ 740,251 $ 1,291,200 $ 684,300 $ 677,IR8 $ 669,352

Net Increase (Decrease) in Fund

Balance s 629,541 s 1,318,237 s (718.365) 1,065,746 1.146,260 582,100 s 175,184 s 4,367 s 89,278

i\ccmal adjustment for GAi\P

Beginning 13udge1a1y Fund Balance $ 1,704,466 $ 2,334,007 $ 3,652,244 7,461,437 8,527,183 9,673,443 $ 480,537 $ 655,721 $ 660,088

Ending Budgetary Fund Balance $ 2,334,007 $ 3,652,2 , 1,1 $ 2,933.�7_2__ - - ____527, 183 2,673,4-13 10,255,543 $ 655,721 $ 660,088 $ 7-19,366

Page 41