Page 43 - Forest Hill FY21 Annual Budget

P. 43

Fore�Hill

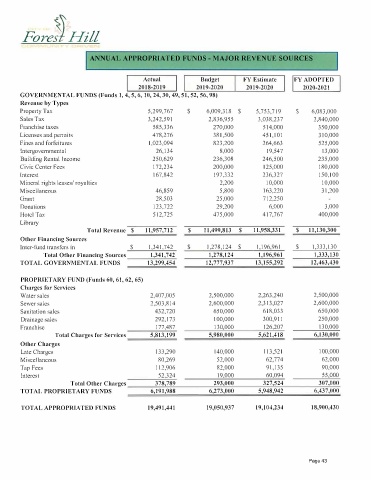

ANNUAL APPROPRIATED FUNDS - MAJOR REVENUE SOURCES

Actual Budget FY Estimate FY ADOPTED

2018-2019 2019-2020 2019-2020 2020-2021

GOVERNMENTAL FUNDS (Funds 1, 4, 5, 6, 10, 24, 30, 49, 51, 52, 56, 98)

Revenue by Types

Property Tax 5,299,767 $ 6,009,318 $ 5,753,719 s 6,083,000

Sales Tax 3,242,591 2,836,955 3,038,237 2,840,000

Franchise taxes 585,336 270,000 514,000 350,000

Licenses and pennits 478,276 381,500 451,101 310,000

Fines and forfeitures 1,023,094 823,200 264,663 525,000

Intergovernmental 26,134 8,000 19,547 13,000

Building Rental Income 250,629 236,308 246,500 235,000

Civic Center Fees 172,234 200,000 125,000 180,000

Interest 167,842 I 97,332 236,327 150,100

Mineral rights leases/ royalties 2,200 10,000 10,000

Miscellaneous 46,859 5,800 163,220 31,200

Grant 28,503 25,000 712,250

Donations 123,722 29,200 6,000 3,000

Hotel Tax 512,725 475,000 417,767 400,000

Library

Total Revenue $ 11,957,712 $ 11,499,813 $ 11,958,331 $ 11,130,300

Other Financing Sources

Inter-fund transfers in $ 1,341,742 $ 1,278,124 $ 1,196,961 $ 1,333,130

Total Other Financing Sources 1,341,742 1,278,124 l, 196,961 l,333, 130

TOTAL GOVERNMENTAL FUNDS 13,299,454 12,777,937 13,155,292 12,463,430

PROPRIETARY FUND (Funds 60, 61, 62, 65)

Charges for Services

Water sales 2,407,005 2,500,000 2,263,240 2,500,000

Sewer sales 2,503,814 2,600,000 2,313,027 2,600,000

Sanitation sales 432,720 650,000 618,033 650,000

Drainage sales 292,173 100,000 300,911 250,000

Franchise 177,487 130,000 126,207 130,000

Total Charges for Services 5,8 I 3, I 99 5,980,000 5,621,418 6,130,000

Other Charges

Late Charges 133,290 140,000 113,521 100,000

Miscellaneous 80,269 52,000 62,774 62,000

Tap Fees 112,906 82,000 91,135 90,000

Interest 52,324 19,000 60,094 55,000

Total Other Charges 378,789 293,000 327,524 307,000

TOTAL PROPRIETARY FUNDS 6,191,988 6,273,000 5,948,942 6,437,000

TOTAL APPROPRIATED FUNDS 19,491,441 19,050,937 I 9,104,234 18,900,430

Page 43