Page 44 - Forest Hill FY21 Annual Budget

P. 44

Fore�Hill

SALES TAX ENTITIES

I Sales Tax

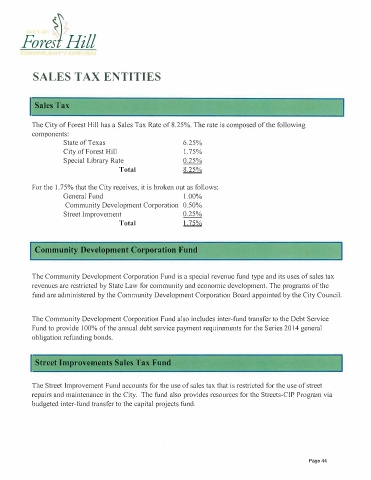

The City of Forest Hill has a Sales Tax Rate of 8.25%. The rate is composed of the following

components:

State of Texas 6.25%

City of Forest Hill 1.75%

Special Library Rate 0.25%

Total R2ll

For the 1.75% that the City receives, it is broken out as follows:

General Fund 1.00%

Community Development Corporation 0.50%

Street Improvement 0.25%

Total 1.75%

Community Development Corporation Fund

The Community Development Corporation Fund is a special revenue fund type and its uses of sales tax

revenues are restricted by State Law for community and economic development. The programs of the

fund are administered by the Community Development Corporation Board appointed by the City Council.

The Community Development Corporation Fund also includes inter-fund transfer to the Debt Service

Fund to provide I 00% of the annual debt service payment requirements for the Series 2014 general

obligation refunding bonds.

I Street Improvements Sales Tax Fund

The Street Improvement Fund accounts for the use of sales tax that is restricted for the use of street

repairs and maintenance in the City. The fund also provides resources for the Streets-CIP Program via

budgeted inter-fund transfer to the capital projects fund.

Page 44