Page 471 - Southlake FY20 Budget

P. 471

Appendix

TAX RATE AllOCATIOn

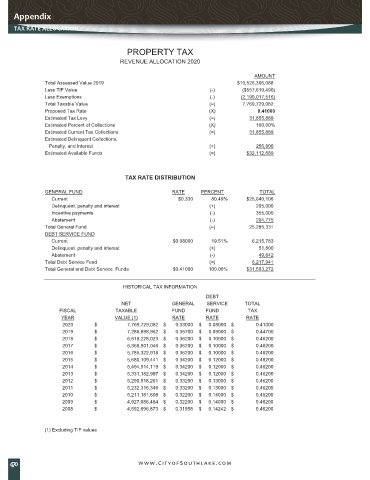

PROPERTY TAX

REVENUE ALLOCATION 2020

AMOUNT

Total Assessed Value 2019 $10,526,366,088

Less TIF Value (-) ($557,619,490)

Less Exemptions (-) (2,199,017,516)

Total Taxable Value (=) 7,769,729,082

Proposed Tax Rate (X) 0.41000

Estimated Tax Levy (=) 31,855,889

Estimated Percent of Collections (X) 100.00%

Estimated Current Tax Collections (=) 31,855,889

Estimated Delinquent Collections,

Penalty, and Interest (+) 256,800

Estimated Available Funds (=) $32,112,689

TAX RATE DISTRIBUTION

GENERAL FUND RATE PERCENT TOTAL

Current $0.330 80.49% $25,640,106

Delinquent, penalty and interest (+) 205,000

Incentive payments (-) 355,000

Abatement (-) 204,775

Total General Fund (=) 25,285,331

DEBT SERVICE FUND

Current $0.08000 19.51% 6,215,783

Delinquent, penalty and interest (+) 51,800

Abatement (-) 49,642

Total Debt Service Fund (=) 6,217,941

Total General and Debt Service Funds $0.41000 100.00% $31,503,272

HISTORICAL TAX INFORMATION

DEBT

NET GENERAL SERVICE TOTAL

FISCAL TAXABLE FUND FUND TAX

YEAR VALUE (1) RATE RATE RATE

2020 $ 7,769,729,082 $ 0.33000 $ 0.08000 $ 0.41000

2019 $ 7,286,898,962 $ 0.35700 $ 0.09000 $ 0.44700

2018 $ 6,618,228,023 $ 0.36200 $ 0.10000 $ 0.46200

2017 $ 6,368,901,046 $ 0.36200 $ 0.10000 $ 0.46200

2016 $ 5,785,322,918 $ 0.36200 $ 0.10000 $ 0.46200

2015 $ 5,680,109,441 $ 0.34200 $ 0.12000 $ 0.46200

2014 $ 5,494,514,119 $ 0.34200 $ 0.12000 $ 0.46200

2013 $ 5,331,182,997 $ 0.34200 $ 0.12000 $ 0.46200

2012 $ 5,290,518,261 $ 0.33200 $ 0.13000 $ 0.46200

2011 $ 5,232,316,346 $ 0.33200 $ 0.13000 $ 0.46200

2010 $ 5,211,181,608 $ 0.32200 $ 0.14000 $ 0.46200

2009 $ 4,927,086,464 $ 0.32200 $ 0.14000 $ 0.46200

2008 $ 4,592,696,873 $ 0.31958 $ 0.14242 $ 0.46200

(1) Excluding TIF values

470 www.CityofSouthlake.com

201,311,239.00 variance between TAD net taxable value and estimated net taxable value