Page 38 - Southlake FY20 Budget

P. 38

Transmittal Letter

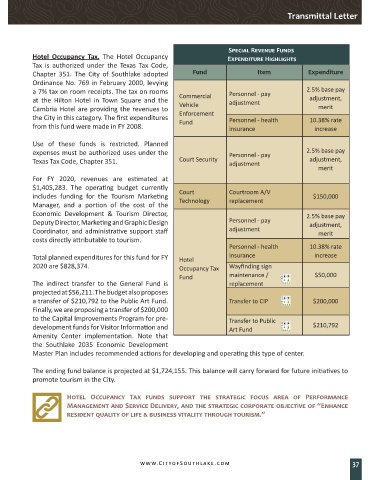

Special Revenue Funds

Hotel Occupancy Tax. The Hotel Occupancy Expenditure Highlights

Tax is authorized under the Texas Tax Code,

Chapter 351. The City of Southlake adopted Fund Item Expenditure

Ordinance No. 769 in February 2000, levying

a 7% tax on room receipts. The tax on rooms Personnel - pay 2.5% base pay

at the Hilton Hotel in Town Square and the Commercial adjustment adjustment,

Vehicle

Cambria Hotel are providing the revenues to merit

the City in this category. The first expenditures Enforcement Personnel - health 10.38% rate

from this fund were made in FY 2008. Fund insurance increase

Use of these funds is restricted. Planned

expenses must be authorized uses under the Personnel - pay 2.5% base pay

Texas Tax Code, Chapter 351. Court Security adjustment adjustment,

merit

For FY 2020, revenues are estimated at

$1,405,283. The operating budget currently Court Courtroom A/V

includes funding for the Tourism Marketing $150,000

Manager, and a portion of the cost of the Technology replacement

Economic Development & Tourism Director, 2.5% base pay

Deputy Director, Marketing and Graphic Design Personnel - pay adjustment,

Coordinator, and administrative support staff adjustment merit

costs directly attributable to tourism.

Personnel - health 10.38% rate

Total planned expenditures for this fund for FY Hotel insurance increase

2020 are $828,374. Occupancy Tax Wayfinding sign

Fund maintenance / $50,000

The indirect transfer to the General Fund is replacement

projected at $56,211. The budget also proposes

a transfer of $210,792 to the Public Art Fund. Transfer to CIP $200,000

Finally, we are proposing a transfer of $200,000

to the Capital Improvements Program for pre- Transfer to Public

development funds for Visitor Information and Art Fund $210,792

Amenity Center implementation. Note that

the Southlake 2035 Economic Development

Master Plan includes recommended actions for developing and operating this type of center.

The ending fund balance is projected at $1,724,155. This balance will carry forward for future initiatives to

promote tourism in the City.

Hotel Occupancy Tax funds support the strategic focus area of Performance

Management and Service Delivery, and the strategic corporate objective of “Enhance

resident quality of life & business vitality through tourism.”

www.CityofSouthl ake.com 37