Page 69 - Grapevine FY20 Approved Budget

P. 69

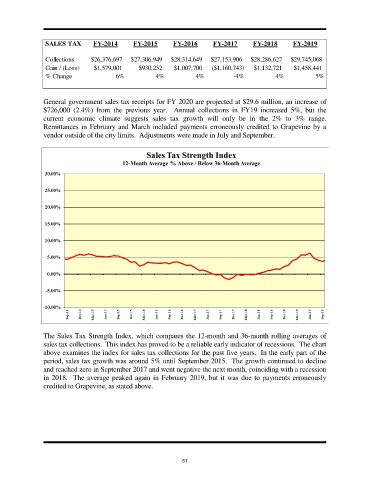

SALES TAX FY-2014 FY-2015 FY-2016 FY-2017 FY-2018 FY-2019

Collections $26,376,697 $27,306,949 $28,314,649 $27,153,906 $28,286,627 $29,745,068

Gain / (Loss) $1,579,001 $930,252 $1,007,700 ($1,160,743) $1,132,721 $1,458,441

% Change 6% 4% 4% -4% 4% 5%

General government sales tax receipts for FY 2020 are projected at $29.6 million, an increase of

$726,000 (2.4%) from the previous year. Annual collections in FY19 increased 5%, but the

current economic climate suggests sales tax growth will only be in the 2% to 3% range.

Remittances in February and March included payments erroneously credited to Grapevine by a

vendor outside of the city limits. Adjustments were made in July and September.

The Sales Tax Strength Index, which compares the 12-month and 36-month rolling averages of

sales tax collections. This index has proved to be a reliable early indicator of recessions. The chart

above examines the index for sales tax collections for the past five years. In the early part of the

period, sales tax growth was around 5% until September 2015. The growth continued to decline

and reached zero in September 2017 and went negative the next month, coinciding with a recession

in 2018. The average peaked again in February 2019, but it was due to payments erroneously

credited to Grapevine, as stated above.

61