Page 68 - Grapevine FY20 Approved Budget

P. 68

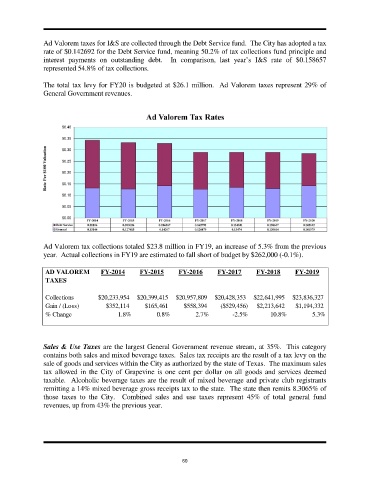

Ad Valorem taxes for I&S are collected through the Debt Service fund. The City has adopted a tax

rate of $0.142692 for the Debt Service fund, meaning 50.2% of tax collections fund principle and

interest payments on outstanding debt. In comparison, last year’s I&S rate of $0.158657

represented 54.8% of tax collections.

The total tax levy for FY20 is budgeted at $26.1 million. Ad Valorem taxes represent 29% of

General Government revenues.

Ad Valorem tax collections totaled $23.8 million in FY19, an increase of 5.3% from the previous

year. Actual collections in FY19 are estimated to fall short of budget by $262,000 (-0.1%).

AD VALOREM FY-2014 FY-2015 FY-2016 FY-2017 FY-2018 FY-2019

TAXES

Collections $20,233,954 $20,399,415 $20,957,809 $20,428,353 $22,641,995 $23,836,327

Gain / (Loss) $352,114 $165,461 $558,394 ($529,456) $2,213,642 $1,194,332

% Change 1.8% 0.8% 2.7% -2.5% 10.8% 5.3%

Sales & Use Taxes are the largest General Government revenue stream, at 35%. This category

contains both sales and mixed beverage taxes. Sales tax receipts are the result of a tax levy on the

sale of goods and services within the City as authorized by the state of Texas. The maximum sales

tax allowed in the City of Grapevine is one cent per dollar on all goods and services deemed

taxable. Alcoholic beverage taxes are the result of mixed beverage and private club registrants

remitting a 14% mixed beverage gross receipts tax to the state. The state then remits 8.3065% of

those taxes to the City. Combined sales and use taxes represent 45% of total general fund

revenues, up from 43% the previous year.

60