Page 101 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 101

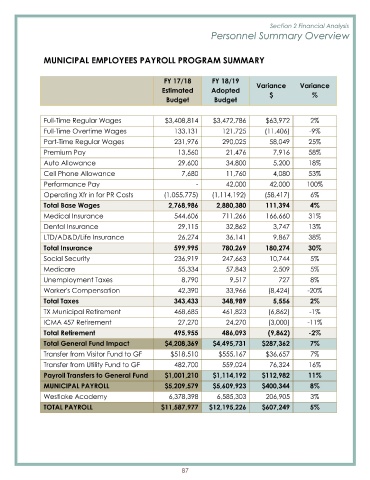

Section 2 Financial Analysis

Personnel Summary Overview

MUNICIPAL EMPLOYEES PAYROLL PROGRAM SUMMARY

FY 17/ 18 FY 18/ 19

Variance Variance

Estimated Adopted

Budget Budget

Full-Time Regular Wages $ 3,408,814 $ 3,472,786 $ 63,972 2%

Full-Time Overtime Wages 133,131 121,725 ( 11,406) - 9%

Part-Time Regular Wages 231,976 290,025 58,049 25%

Premium Pay 13,560 21,476 7,916 58%

Auto Allowance 29,600 34,800 5,200 18%

Cell Phone Allowance 7,680 11,760 4,080 53%

Performance Pay - 42,000 42,000 100%

Operating Xfr in for PR Costs ( 1,055,775) ( 1,114,192) ( 58,417) 6%

Total Base Wages 2,768,986 2,880,380 111,394 4%

Medical Insurance 544,606 711,266 166,660 31%

Dental Insurance 29,115 32,862 3,747 13%

LTD/ AD& D/ Life Insurance 26,274 36,141 9,867 38%

Total Insurance 599,995 780,269 180,274 30%

Social Security 236,919 247,663 10,744 5%

Medicare 55,334 57,843 2,509 5%

Unemployment Taxes 8,790 9,517 727 8%

Worker's Compensation 42,390 33,966 ( 8,424) - 20%

Total Taxes 343,433 348,989 5,556 2%

TX Municipal Retirement 468,685 461,823 ( 6,862) - 1%

ICMA 457 Retirement 27,270 24,270 ( 3,000) - 11%

Total Retirement 495,955 486,093 ( 9,862) - 2%

Total General Fund Impact $ 4,208,369 $ 4,495,731 $ 287,362 7%

Transfer from Visitor Fund to GF $ 518,510 $ 555,167 $ 36,657 7%

Transfer from Utility Fund to GF 482,700 559,024 76,324 16%

Payroll Transfers to General Fund $ 1,001,210 $ 1,114,192 $ 112,982 11%

MUNICIPAL PAYROLL $ 5,209,579 $ 5,609,923 $ 400,344 8%

Westlake Academy 6,378,398 6,585,303 206,905 3%

TOTAL PAYROLL $ 11,587,977 $ 12,195,226 $ 607,249 5%

87