Page 73 - FY 19 Budget Forecast 91218.xlsx

P. 73

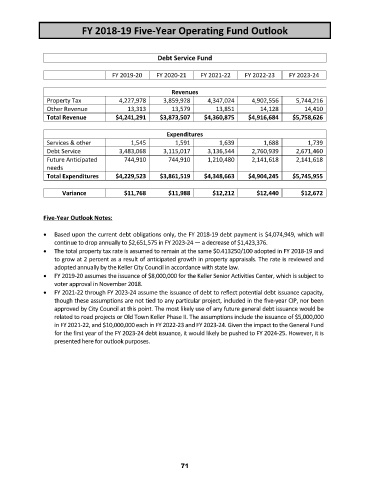

FY 2018‐19 Five‐Year Operating Fund Outlook

Debt Service Fund

FY 2019‐20 FY 2020‐21 FY 2021‐22 FY 2022‐23 FY 2023‐24

Revenues

Property Tax 4,227,978 3,859,928 4,347,024 4,902,556 5,744,216

Other Revenue 13,313 13,579 13,851 14,128 14,410

Total Revenue $4,241,291 $3,873,507 $4,360,875 $4,916,684 $5,758,626

Expenditures

Services & other 1,545 1,591 1,639 1,688 1,739

Debt Service 3,483,068 3,115,017 3,136,544 2,760,939 2,671,460

Future Anticipated 744,910 744,910 1,210,480 2,141,618 2,141,618

needs

Total Expenditures $4,229,523 $3,861,519 $4,348,663 $4,904,245 $5,745,955

Variance $11,768 $11,988 $12,212 $12,440 $12,672

Five‐Year Outlook Notes:

Based upon the current debt obligations only, the FY 2018‐19 debt payment is $4,074,949, which will

continue to drop annually to $2,651,575 in FY 2023‐24 — a decrease of $1,423,376.

The total property tax rate is assumed to remain at the same $0.413250/100 adopted in FY 2018‐19 and

to grow at 2 percent as a result of anticipated growth in property appraisals. The rate is reviewed and

adopted annually by the Keller City Council in accordance with state law.

FY 2019‐20 assumes the issuance of $8,000,000 for the Keller Senior Activities Center, which is subject to

voter approval in November 2018.

FY 2021‐22 through FY 2023‐24 assume the issuance of debt to reflect potential debt issuance capacity,

though these assumptions are not tied to any particular project, included in the five‐year CIP, nor been

approved by City Council at this point. The most likely use of any future general debt issuance would be

related to road projects or Old Town Keller Phase II. The assumptions include the issuance of $5,000,000

in FY 2021‐22, and $10,000,000 each in FY 2022‐23 and FY 2023‐24. Given the impact to the General Fund

for the first year of the FY 2023‐24 debt issuance, it would likely be pushed to FY 2024‐25. However, it is

presented here for outlook purposes.

71