Page 72 - FY 19 Budget Forecast 91218.xlsx

P. 72

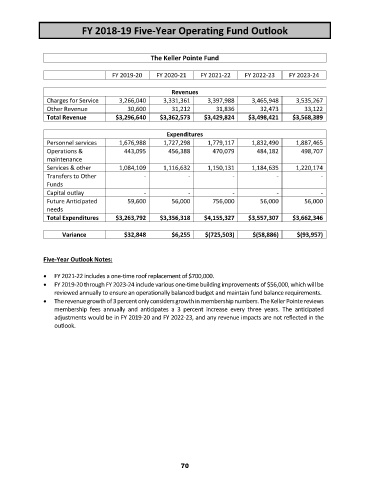

FY 2018‐19 Five‐Year Operating Fund Outlook

The Keller Pointe Fund

FY 2019‐20 FY 2020‐21 FY 2021‐22 FY 2022‐23 FY 2023‐24

Revenues

Charges for Service 3,266,040 3,331,361 3,397,988 3,465,948 3,535,267

Other Revenue 30,600 31,212 31,836 32,473 33,122

Total Revenue $3,296,640 $3,362,573 $3,429,824 $3,498,421 $3,568,389

Expenditures

Personnel services 1,676,988 1,727,298 1,779,117 1,832,490 1,887,465

Operations & 443,095 456,388 470,079 484,182 498,707

maintenance

Services & other 1,084,109 1,116,632 1,150,131 1,184,635 1,220,174

Transfers to Other ‐ ‐ ‐ ‐ ‐

Funds

Capital outlay ‐ ‐ ‐ ‐ ‐

Future Anticipated 59,600 56,000 756,000 56,000 56,000

needs

Total Expenditures $3,263,792 $3,356,318 $4,155,327 $3,557,307 $3,662,346

Variance $32,848 $6,255 $(725,503) $(58,886) $(93,957)

Five‐Year Outlook Notes:

FY 2021‐22 includes a one‐time roof replacement of $700,000.

FY 2019‐20 through FY 2023‐24 include various one‐time building improvements of $56,000, which will be

reviewed annually to ensure an operationally balanced budget and maintain fund balance requirements.

The revenue growth of 3 percent only considers growth in membership numbers. The Keller Pointe reviews

membership fees annually and anticipates a 3 percent increase every three years. The anticipated

adjustments would be in FY 2019‐20 and FY 2022‐23, and any revenue impacts are not reflected in the

outlook.

70