Page 46 - FY 19 Budget Forecast 91218.xlsx

P. 46

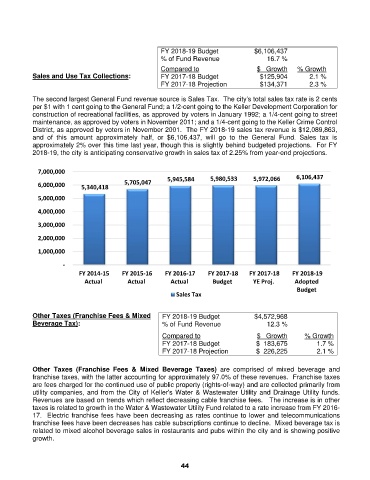

FY 2018-19 Budget $6,106,437

% of Fund Revenue 16.7 %

Compared to $ Growth % Growth

Sales and Use Tax Collections: FY 2017-18 Budget $125,904 2.1 %

FY 2017-18 Projection $134,371 2.3 %

The second largest General Fund revenue source is Sales Tax. The city’s total sales tax rate is 2 cents

per $1 with 1 cent going to the General Fund; a 1/2-cent going to the Keller Development Corporation for

construction of recreational facilities, as approved by voters in January 1992; a 1/4-cent going to street

maintenance, as approved by voters in November 2011; and a 1/4-cent going to the Keller Crime Control

District, as approved by voters in November 2001. The FY 2018-19 sales tax revenue is $12,089,863,

and of this amount approximately half, or $6,106,437, will go to the General Fund. Sales tax is

approximately 2% over this time last year, though this is slightly behind budgeted projections. For FY

2018-19, the city is anticipating conservative growth in sales tax of 2.25% from year-end projections.

7,000,000

5,945,584 5,980,533 5,972,066 6,106,437

6,000,000 5,340,418 5,705,047

5,000,000

4,000,000

3,000,000

2,000,000

1,000,000

‐

FY 2014‐15 FY 2015‐16 FY 2016‐17 FY 2017‐18 FY 2017‐18 FY 2018‐19

Actual Actual Actual Budget YE Proj. Adopted

Budget

Sales Tax

Other Taxes (Franchise Fees & Mixed FY 2018-19 Budget $4,572,968

Beverage Tax): % of Fund Revenue 12.3 %

Compared to $ Growth % Growth

FY 2017-18 Budget $ 183,675 1.7 %

FY 2017-18 Projection $ 226,225 2.1 %

Other Taxes (Franchise Fees & Mixed Beverage Taxes) are comprised of mixed beverage and

franchise taxes, with the latter accounting for approximately 97.0% of these revenues. Franchise taxes

are fees charged for the continued use of public property (rights-of-way) and are collected primarily from

utility companies, and from the City of Keller's Water & Wastewater Utility and Drainage Utility funds.

Revenues are based on trends which reflect decreasing cable franchise fees. The increase is in other

taxes is related to growth in the Water & Wastewater Utility Fund related to a rate increase from FY 2016-

17. Electric franchise fees have been decreasing as rates continue to lower and telecommunications

franchise fees have been decreases has cable subscriptions continue to decline. Mixed beverage tax is

related to mixed alcohol beverage sales in restaurants and pubs within the city and is showing positive

growth.

44