Page 45 - FY 19 Budget Forecast 91218.xlsx

P. 45

Ad Valorem Taxes:

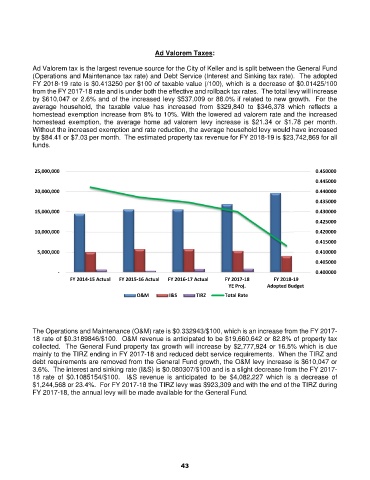

Ad Valorem tax is the largest revenue source for the City of Keller and is split between the General Fund

(Operations and Maintenance tax rate) and Debt Service (Interest and Sinking tax rate). The adopted

FY 2018-19 rate is $0.413250 per $100 of taxable value (/100), which is a decrease of $0.01425/100

from the FY 2017-18 rate and is under both the effective and rollback tax rates. The total levy will increase

by $610,047 or 2.6% and of the increased levy $537,009 or 88.0% if related to new growth. For the

average household, the taxable value has increased from $329,840 to $346,378 which reflects a

homestead exemption increase from 8% to 10%. With the lowered ad valorem rate and the increased

homestead exemption, the average home ad valorem levy increase is $21.34 or $1.78 per month.

Without the increased exemption and rate reduction, the average household levy would have increased

by $84.41 or $7.03 per month. The estimated property tax revenue for FY 2018-19 is $23,742,869 for all

funds.

25,000,000 0.450000

0.445000

20,000,000 0.440000

0.435000

15,000,000 0.430000

0.425000

10,000,000 0.420000

0.415000

5,000,000 0.410000

0.405000

‐ 0.400000

FY 2014‐15 Actual FY 2015‐16 Actual FY 2016‐17 Actual FY 2017‐18 FY 2018‐19

YE Proj. Adopted Budget

O&M I&S TIRZ Total Rate

The Operations and Maintenance (O&M) rate is $0.332943/$100, which is an increase from the FY 2017-

18 rate of $0.3189846/$100. O&M revenue is anticipated to be $19,660,642 or 82.8% of property tax

collected. The General Fund property tax growth will increase by $2,777,924 or 16.5% which is due

mainly to the TIRZ ending in FY 2017-18 and reduced debt service requirements. When the TIRZ and

debt requirements are removed from the General Fund growth, the O&M levy increase is $610,047 or

3.6%. The interest and sinking rate (I&S) is $0.080307/$100 and is a slight decrease from the FY 2017-

18 rate of $0.1085154/$100. I&S revenue is anticipated to be $4,082,227 which is a decrease of

$1,244,568 or 23.4%. For FY 2017-18 the TIRZ levy was $923,309 and with the end of the TIRZ during

FY 2017-18, the annual levy will be made available for the General Fund.

43