Page 124 - Haltom City FY19 Annual Budget

P. 124

CAPITAL PROJECTS FUNDS DESCRIPTION

The City of Haltom City develops a multi-year financial plan for all capital projects in conjunction

with the development of a multi-year operational plan. These capital improvement plans (CIP)

are developed during the budget process and are adopted by the City Council along with the

proposed operating budget.

Criterion for Selection and Budgetary Impact

Improvements to be included in the CIP are selected and prioritized according to the critical

nature of the project and the timeliness of available financing for the project. The following

operation impacts are considered:

• Demolition and salvage costs

• Changes in city-wide utility costs, maintenance costs and personnel costs

• Impact of regulatory compliance upon operations

• Impact of avoided costs

• Impact of deferred maintenance

All improvements completed in the CIP have a useful life that exceeds the life of the financing.

Capital equipment considered for inclusion in the CIP must have an initial acquisition cost of at

least $5,000 and a useful life of at least 2 years.

Sources of Funding

Sources of funding for the capital projects include:

• Reserve funds or carryover balances from prior years

• Current resources from operations

• 3/8 cents of sales tax

• Grants and contributions

• Transfers from other funds

• Bond proceeds from tax and revenue supported debts

Funding for the FY2019 capital projects are mainly from fund balances, transfers, sales tax

and bond proceeds.

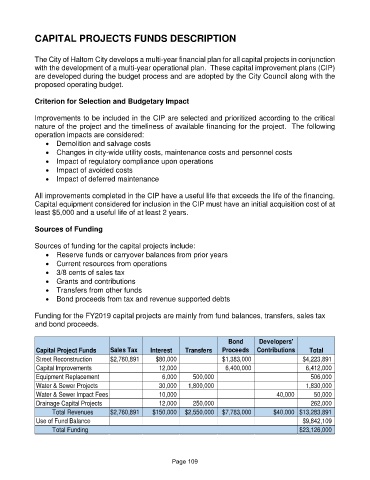

Bond Developers'

Capital Project Funds Sales Tax Interest Transfers Proceeds Contributions Total

Street Reconstruction $2,760,891 $80,000 $1,383,000 $4,223,891

Capital Improvements 12,000 6,400,000 6,412,000

Equipment Replacement 6,000 500,000 506,000

Water & Sewer Projects 30,000 1,800,000 1,830,000

Water & Sewer Impact Fees 10,000 40,000 50,000

Drainage Capital Projects 12,000 250,000 262,000

Total Revenues $2,760,891 $150,000 $2,550,000 $7,783,000 $40,000 $13,283,891

Use of Fund Balance $9,842,109

Total Funding $23,126,000

Page 109