Page 12 - Haltom City FY19 Annual Budget

P. 12

taxable value may be necessary once the total bond issuance was complete. The

FY2019 Debt Service Fund is set at $0.23, which will provide about $5 million of debt

service payments.

Sales Tax – Sales tax is the largest revenue source for the City, with over $14.7 million

estimated for FY2019. For FY2019, the allocation will be 1.375% for General Fund, 0.0%

for Economic Development Corporation, 0.375% for Streets, and 0.25% for Crime Control

and Prevention District. Since there will be no direct funding from sales tax for the

Economic Development Corporation, transfers from General Fund to the Economic

Development Corporation will be needed for current operations and debt service.

Infrastructure Maintenance – One long-term concern has been providing enough

funding each year to maintain the City’s existing and aging infrastructure – primarily

streets. Many Cities are facing challenges with aging infrastructure and will be forced to

absorb large reconstruction costs in the future if annual maintenance is not sufficient in

the years following original road construction. The City Council allocated 3/8 of a cent of

sales tax for streets since FY2017. The total revenues from Sales Tax dedicated to the

Street Reconstruction Fund for FY2019 are in excess of $2.7 million.

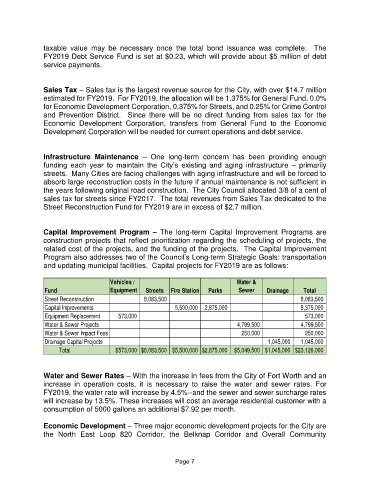

Capital Improvement Program – The long-term Capital Improvement Programs are

construction projects that reflect prioritization regarding the scheduling of projects, the

related cost of the projects, and the funding of the projects. The Capital Improvement

Program also addresses two of the Council’s Long-term Strategic Goals: transportation

and updating municipal facilities. Capital projects for FY2019 are as follows:

Vehicles / Water &

Fund Equipment Streets Fire Station Parks Sewer Drainage Total

Street Reconstruction 8,083,500 8,083,500

Capital Improvements 5,500,000 2,875,000 8,375,000

Equipment Replacement 573,000 573,000

Water & Sewer Projects 4,799,500 4,799,500

Water & Sewer Impact Fees 250,000 250,000

Drainage Capital Projects 1,045,000 1,045,000

Total $573,000 $8,083,500 $5,500,000 $2,875,000 $5,049,500 $1,045,000 $23,126,000

Water and Sewer Rates – With the increase in fees from the City of Fort Worth and an

increase in operation costs, it is necessary to raise the water and sewer rates. For

FY2019, the water rate will increase by 4.5%--and the sewer and sewer surcharge rates

will increase by 13.5%. These increases will cost an average residential customer with a

consumption of 5000 gallons an additional $7.92 per month.

Economic Development – Three major economic development projects for the City are

the North East Loop 820 Corridor, the Belknap Corridor and Overall Community

Page 7