Page 225 - Grapevine FY19 Operating Budget

P. 225

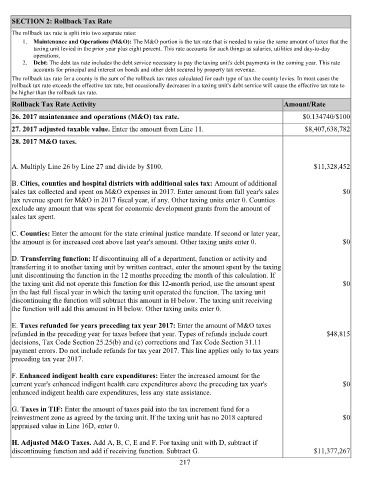

SECTION 2: Rollback Tax Rate

The rollback tax rate is split into two separate rates:

1. Maintenance and Operations (M&O): The M&O portion is the tax rate that is needed to raise the same amount of taxes that the

taxing unit levied in the prior year plus eight percent. This rate accounts for such things as salaries, utilities and day-to-day

operations.

2. Debt: The debt tax rate includes the debt service necessary to pay the taxing unit's debt payments in the coming year. This rate

accounts for principal and interest on bonds and other debt secured by property tax revenue.

The rollback tax rate for a county is the sum of the rollback tax rates calculated for each type of tax the county levies. In most cases the

rollback tax rate exceeds the effective tax rate, but occasionally decreases in a taxing unit's debt service will cause the effective tax rate to

be higher than the rollback tax rate.

Rollback Tax Rate Activity Amount/Rate

26. 2017 maintenance and operations (M&O) tax rate. $0.134740/$100

27. 2017 adjusted taxable value. Enter the amount from Line 11. $8,407,638,782

28. 2017 M&O taxes.

A. Multiply Line 26 by Line 27 and divide by $100. $11,328,452

B. Cities, counties and hospital districts with additional sales tax: Amount of additional

sales tax collected and spent on M&O expenses in 2017. Enter amount from full year's sales $0

tax revenue spent for M&O in 2017 fiscal year, if any. Other taxing units enter 0. Counties

exclude any amount that was spent for economic development grants from the amount of

sales tax spent.

C. Counties: Enter the amount for the state criminal justice mandate. If second or later year,

the amount is for increased cost above last year's amount. Other taxing units enter 0. $0

D. Transferring function: If discontinuing all of a department, function or activity and

transferring it to another taxing unit by written contract, enter the amount spent by the taxing

unit discontinuing the function in the 12 months preceding the month of this calculation. If

the taxing unit did not operate this function for this 12-month period, use the amount spent $0

in the last full fiscal year in which the taxing unit operated the function. The taxing unit

discontinuing the function will subtract this amount in H below. The taxing unit receiving

the function will add this amount in H below. Other taxing units enter 0.

E. Taxes refunded for years preceding tax year 2017: Enter the amount of M&O taxes

refunded in the preceding year for taxes before that year. Types of refunds include court $48,815

decisions, Tax Code Section 25.25(b) and (c) corrections and Tax Code Section 31.11

payment errors. Do not include refunds for tax year 2017. This line applies only to tax years

preceding tax year 2017.

F. Enhanced indigent health care expenditures: Enter the increased amount for the

current year's enhanced indigent health care expenditures above the preceding tax year's $0

enhanced indigent health care expenditures, less any state assistance.

G. Taxes in TIF: Enter the amount of taxes paid into the tax increment fund for a

reinvestment zone as agreed by the taxing unit. If the taxing unit has no 2018 captured $0

appraised value in Line 16D, enter 0.

H. Adjusted M&O Taxes. Add A, B, C, E and F. For taxing unit with D, subtract if

discontinuing function and add if receiving function. Subtract G. $11,377,267

217