Page 227 - Grapevine FY19 Operating Budget

P. 227

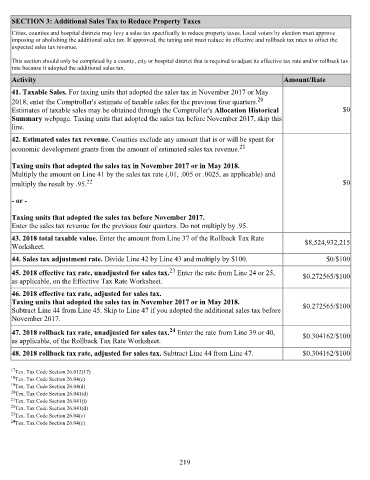

SECTION 3: Additional Sales Tax to Reduce Property Taxes

Cities, counties and hospital districts may levy a sales tax specifically to reduce property taxes. Local voters by election must approve

imposing or abolishing the additional sales tax. If approved, the taxing unit must reduce its effective and rollback tax rates to offset the

expected sales tax revenue.

This section should only be completed by a county, city or hospital district that is required to adjust its effective tax rate and/or rollback tax

rate because it adopted the additional sales tax.

Activity Amount/Rate

41. Taxable Sales. For taxing units that adopted the sales tax in November 2017 or May

2018, enter the Comptroller's estimate of taxable sales for the previous four quarters. 20

Estimates of taxable sales may be obtained through the Comptroller's Allocation Historical $0

Summary webpage. Taxing units that adopted the sales tax before November 2017, skip this

line.

42. Estimated sales tax revenue. Counties exclude any amount that is or will be spent for

21

economic development grants from the amount of estimated sales tax revenue.

Taxing units that adopted the sales tax in November 2017 or in May 2018.

Multiply the amount on Line 41 by the sales tax rate (.01, .005 or .0025, as applicable) and

multiply the result by .95. 22 $0

- or -

Taxing units that adopted the sales tax before November 2017.

Enter the sales tax revenue for the previous four quarters. Do not multiply by .95.

43. 2018 total taxable value. Enter the amount from Line 37 of the Rollback Tax Rate $8,524,932,215

Worksheet.

44. Sales tax adjustment rate. Divide Line 42 by Line 43 and multiply by $100. $0/$100

23

45. 2018 effective tax rate, unadjusted for sales tax. Enter the rate from Line 24 or 25, $0.272565/$100

as applicable, on the Effective Tax Rate Worksheet.

46. 2018 effective tax rate, adjusted for sales tax.

Taxing units that adopted the sales tax in November 2017 or in May 2018. $0.272565/$100

Subtract Line 44 from Line 45. Skip to Line 47 if you adopted the additional sales tax before

November 2017.

24

47. 2018 rollback tax rate, unadjusted for sales tax. Enter the rate from Line 39 or 40, $0.304162/$100

as applicable, of the Rollback Tax Rate Worksheet.

48. 2018 rollback tax rate, adjusted for sales tax. Subtract Line 44 from Line 47. $0.304162/$100

17 Tex. Tax Code Section 26.012(17)

18 Tex. Tax Code Section 26.04(c)

19 Tex. Tax Code Section 26.04(d)

20 Tex. Tax Code Section 26.041(d)

21 Tex. Tax Code Section 26.041(i)

22 Tex. Tax Code Section 26.041(d)

23 Tex. Tax Code Section 26.04(c)

24 Tex. Tax Code Section 26.04(c)

219