Page 223 - Grapevine FY19 Operating Budget

P. 223

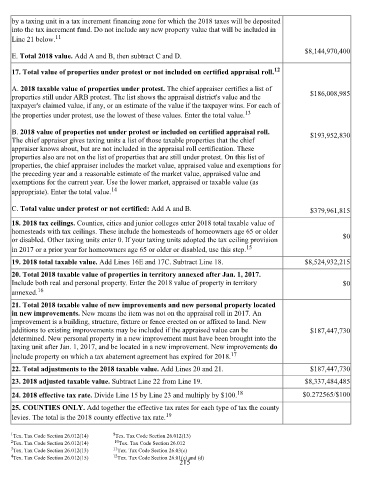

by a taxing unit in a tax increment financing zone for which the 2018 taxes will be deposited

into the tax increment fund. Do not include any new property value that will be included in

11

Line 21 below.

$8,144,970,400

E. Total 2018 value. Add A and B, then subtract C and D.

17. Total value of properties under protest or not included on certified appraisal roll. 12

A. 2018 taxable value of properties under protest. The chief appraiser certifies a list of

properties still under ARB protest. The list shows the appraisal district's value and the $186,008,985

taxpayer's claimed value, if any, or an estimate of the value if the taxpayer wins. For each of

the properties under protest, use the lowest of these values. Enter the total value. 13

B. 2018 value of properties not under protest or included on certified appraisal roll. $193,952,830

The chief appraiser gives taxing units a list of those taxable properties that the chief

appraiser knows about, but are not included in the appraisal roll certification. These

properties also are not on the list of properties that are still under protest. On this list of

properties, the chief appraiser includes the market value, appraised value and exemptions for

the preceding year and a reasonable estimate of the market value, appraised value and

exemptions for the current year. Use the lower market, appraised or taxable value (as

appropriate). Enter the total value. 14

C. Total value under protest or not certified: Add A and B. $379,961,815

18. 2018 tax ceilings. Counties, cities and junior colleges enter 2018 total taxable value of

homesteads with tax ceilings. These include the homesteads of homeowners age 65 or older

or disabled. Other taxing units enter 0. If your taxing units adopted the tax ceiling provision $0

in 2017 or a prior year for homeowners age 65 or older or disabled, use this step. 15

19. 2018 total taxable value. Add Lines 16E and 17C. Subtract Line 18. $8,524,932,215

20. Total 2018 taxable value of properties in territory annexed after Jan. 1, 2017.

Include both real and personal property. Enter the 2018 value of property in territory $0

16

annexed.

21. Total 2018 taxable value of new improvements and new personal property located

in new improvements. New means the item was not on the appraisal roll in 2017. An

improvement is a building, structure, fixture or fence erected on or affixed to land. New

additions to existing improvements may be included if the appraised value can be $187,447,730

determined. New personal property in a new improvement must have been brought into the

taxing unit after Jan. 1, 2017, and be located in a new improvement. New improvements do

include property on which a tax abatement agreement has expired for 2018. 17

22. Total adjustments to the 2018 taxable value. Add Lines 20 and 21. $187,447,730

23. 2018 adjusted taxable value. Subtract Line 22 from Line 19. $8,337,484,485

24. 2018 effective tax rate. Divide Line 15 by Line 23 and multiply by $100. 18 $0.272565/$100

25. COUNTIES ONLY. Add together the effective tax rates for each type of tax the county

levies. The total is the 2018 county effective tax rate. 19

9

1 Tex. Tax Code Section 26.012(14) Tex. Tax Code Section 26.012(13)

10

2 Tex. Tax Code Section 26.012(14) Tex. Tax Code Section 26.012

3 Tex. Tax Code Section 26.012(13) Tex. Tax Code Section 26.03(c)

11

4 Tex. Tax Code Section 26.012(15) Tex. Tax Code Section 26.01(c) and (d)

12

215